Use these links to rapidly review the document

TABLE OF CONTENTS

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

PART IV

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

| FORM 10-K | ||||

| ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2012 |

|||

OR |

||||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to |

| Commission File Number |

Registrant; State of Incorporation; Address; and Telephone Number |

IRS Employer Identification No. |

||

| 1-9513 | CMS ENERGY CORPORATION | 38-2726431 | ||

| (A Michigan Corporation) One Energy Plaza, Jackson, Michigan 49201 (517) 788-0550 |

||||

1-5611 |

CONSUMERS ENERGY COMPANY |

38-0442310 |

||

| (A Michigan Corporation) One Energy Plaza, Jackson, Michigan 49201 (517) 788-0550 |

||||

Securities registered pursuant to Section 12(b) of the Act:

Registrant |

Title of Class | Name of Each Exchange on Which Registered |

||

| CMS Energy Corporation | Common Stock, $0.01 par value | New York Stock Exchange | ||

| Consumers Energy Company | Preferred Stocks, $100 par value: $4.16 Series, $4.50 Series |

New York Stock Exchange | ||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate

by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

CMS Energy

Corporation: Yes ý No o Consumers

Energy Company: Yes ý No o

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

CMS Energy

Corporation: Yes o No ý Consumers

Energy Company: Yes o No ý

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during

the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past

90 days.

CMS Energy

Corporation: Yes ý Noo Consumers

Energy Company: Yes ý Noo

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and

posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was

required to submit and post such files).

CMS Energy

Corporation: Yes ý No o Consumers

Energy Company: Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the

definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

CMS Energy Corporation:

Large accelerated

filer ý Accelerated filer o Non-Accelerated

filer o Smaller reporting company o

(Do not check if a smaller reporting company)

Consumers Energy Company:

Large accelerated filer o Accelerated

filer o Non-Accelerated filer ý Smaller reporting

company o

(Do not check if a smaller reporting company)

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

CMS Energy

Corporation: Yes o No ý Consumers

Energy Company: Yes o No ý

The aggregate market value of CMS Energy voting and non-voting common equity held by non-affiliates was $6.165 billion for the 262,346,966 CMS Energy Common Stock shares outstanding on June 29, 2012 based on the closing sale price of $23.50 for CMS Energy Common Stock, as reported by the New York Stock Exchange on such date.

There were 265,935,441 shares of CMS Energy Common Stock outstanding on February 8, 2013, including 1,091,320 shares owned by Consumers Energy Company. On February 21, 2013, CMS Energy held all voting and non-voting common equity of Consumers. Documents incorporated by reference in Part III: CMS Energy's proxy statement and Consumers' information statement relating to the 2013 annual meeting of stockholders to be held May 17, 2013.

CMS Energy Corporation

Consumers Energy Company

Annual Reports on Form 10-K to the Securities and Exchange Commission for the Year Ended December 31, 2012

1

(This page intentionally left blank)

2

Certain terms used in the text and financial statements are defined below.

| 2008 Energy Law | Comprehensive energy reform package enacted in Michigan in 2008 | |

| ABATE | Association of Businesses Advocating Tariff Equity | |

| ABO | Accumulated benefit obligation; the liabilities of a pension plan based on service and pay to date, which differs from the PBO in that it does not reflect expected future salary increases | |

| AFUDC | Allowance for borrowed and equity funds used during construction | |

| AOCI | Accumulated other comprehensive income (loss) | |

| ARO | Asset retirement obligation | |

| ASU | Financial Accounting Standards Board Accounting Standards Update | |

| Bay Harbor | A residential/commercial real estate area located near Petoskey, Michigan, in which CMS Energy sold its interest in 2002 | |

| bcf | Billion cubic feet | |

| Big Rock | Big Rock Point nuclear power plant, formerly owned by Consumers | |

| Btu | British thermal unit | |

| CAIR | The Clean Air Interstate Rule | |

| Cantera Gas Company | Cantera Gas Company LLC, a non-affiliated company, formerly known as CMS Field Services | |

| Cantera Natural Gas, Inc. | Cantera Natural Gas, Inc., a non-affiliated company that purchased CMS Field Services | |

| CAO | Chief Accounting Officer | |

| CCR | Coal combustion residual | |

| CEO | Chief Executive Officer | |

| CFO | Chief Financial Officer | |

| C&HR Committees | The Compensation and Human Resources Committees of the Boards of Directors of CMS Energy and Consumers | |

| city-gate contract | An arrangement made for the point at which a local distribution company physically receives gas from a supplier or pipeline | |

3

| Clean Air Act | Federal Clean Air Act of 1963, as amended | |

| Clean Water Act | Federal Water Pollution Control Act of 1972, as amended | |

| CMS Capital | CMS Capital, L.L.C., a wholly owned subsidiary of CMS Energy | |

| CMS Energy | CMS Energy Corporation, the parent of Consumers and CMS Enterprises | |

| CMS Enterprises | CMS Enterprises Company, a wholly owned subsidiary of CMS Energy | |

| CMS ERM | CMS Energy Resource Management Company, formerly CMS MST, a wholly owned subsidiary of CMS Enterprises | |

| CMS Field Services | CMS Field Services, Inc., a former wholly owned subsidiary of CMS Gas Transmission | |

| CMS Gas Transmission | CMS Gas Transmission Company, a wholly owned subsidiary of CMS Enterprises | |

| CMS Generation San Nicolas Company | CMS Generation San Nicolas Company, a company in which CMS Enterprises formerly owned a 0.1 percent interest | |

| CMS Land | CMS Land Company, a wholly owned subsidiary of CMS Capital | |

| CMS MST | CMS Marketing, Services and Trading Company, a wholly owned subsidiary of CMS Enterprises, whose name was changed to CMS ERM in 2004 | |

| CMS Viron | CMS Viron Corporation, a wholly owned subsidiary of CMS ERM | |

| Consumers | Consumers Energy Company, a wholly owned subsidiary of CMS Energy | |

| Consumers Funding | Consumers Funding LLC, a wholly owned consolidated bankruptcy-remote subsidiary of Consumers and special-purpose entity organized for the sole purpose of purchasing and owning Securitization property, assuming Securitization bonds, and pledging its interest in Securitization property to a trustee to collateralize the Securitization bonds | |

| CSAPR | The Cross-State Air Pollution Rule | |

| Customer Choice Act | Customer Choice and Electricity Reliability Act, a Michigan statute | |

| DB SERP | Defined Benefit Supplemental Executive Retirement Plan | |

| DCCP | Defined Company Contribution Plan | |

| DC SERP | Defined Contribution Supplemental Executive Retirement Plan | |

4

| DIG | Dearborn Industrial Generation, L.L.C., a wholly owned subsidiary of Dearborn Industrial Energy, L.L.C., a wholly owned subsidiary of CMS Energy | |

| Dodd-Frank Act | Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 | |

| DOE | U.S. Department of Energy | |

| DOJ | U.S. Department of Justice | |

| DTE Electric | DTE Electric Company, a non-affiliated company | |

| EBITDA | Earnings before interest, taxes, depreciation, and amortization | |

| EnerBank | EnerBank USA, a wholly owned subsidiary of CMS Capital | |

| Entergy | Entergy Corporation, a non-affiliated company | |

| EPA | U.S. Environmental Protection Agency | |

| EPS | Earnings per share | |

| Exchange Act | Securities Exchange Act of 1934, as amended | |

| Exeter | Exeter Energy Limited Partnership, sold by CMS Energy to ReEnergy Sterling LLC, a non-affiliated company, in 2011 | |

| FDIC | Federal Deposit Insurance Corporation | |

| FERC | The Federal Energy Regulatory Commission | |

| fine particulate matter | Particulate matter that is 2.5 microns or less in diameter | |

| First Mortgage Bond Indenture | The indenture dated as of September 1, 1945 between Consumers and The Bank of New York Mellon, as Trustee, as amended and supplemented | |

| FLI Liquidating Trust | Trust formed in Missouri bankruptcy court to accomplish the liquidation of Farmland Industries, Inc., a non-affiliated entity | |

| FMB | First mortgage bond | |

| FOV | Finding of Violation | |

| GAAP | U.S. Generally Accepted Accounting Principles | |

| GCC | Gas Customer Choice, which allows gas customers to purchase gas from alternative suppliers | |

| GCR | Gas cost recovery | |

5

| Genesee | Genesee Power Station Limited Partnership, a VIE in which HYDRA-CO Enterprises, Inc., a wholly owned subsidiary of CMS Enterprises, has a 50 percent interest | |

| Grayling | Grayling Generating Station Limited Partnership, a VIE in which HYDRA-CO Enterprises, Inc., a wholly owned subsidiary of CMS Enterprises, has a 50 percent interest | |

| GWh | Gigawatt-hour, a unit of energy equal to one billion watt-hours | |

| Health Care Acts | Comprehensive health care reform enacted in March 2010, comprising the Patient Protection and Affordable Care Act and the related Health Care and Education Reconciliation Act | |

| IRS | Internal Revenue Service | |

| ISFSI | Independent spent fuel storage installation | |

| kilovolts | Thousand volts, a unit used to measure the difference in electrical pressure along a current | |

| kVA | Thousand volt-amperes, a unit used to reflect the electrical power capacity rating of equipment or a system | |

| kWh | Kilowatt-hour, a unit of energy equal to one thousand watt-hours | |

| LIBOR | The London Interbank Offered Rate | |

| Ludington | Ludington pumped-storage plant, jointly owned by Consumers and DTE Electric | |

| MACT | Maximum Achievable Control Technology, which is the emission control that is achieved in practice by the best-controlled similar source | |

| MATS | Mercury and Air Toxic Standards, which limit mercury, acid gases, and other toxic pollution from coal-fueled and oil-fueled power plants | |

| MBT | Michigan Business Tax | |

| mcf | Thousand cubic feet | |

| MCIT | Michigan Corporate Income Tax | |

| MCV Facility | A 1,500 MW gas-fueled, combined-cycle cogeneration facility operated by the MCV Partnership | |

| MCV Partnership | Midland Cogeneration Venture Limited Partnership | |

| MCV PPA | PPA between Consumers and the MCV Partnership | |

| MD&A | Management's Discussion and Analysis of Financial Condition and Results of Operations | |

6

| MDEQ | Michigan Department of Environmental Quality | |

| MDL | A pending multi-district litigation case in Nevada | |

| MGP | Manufactured gas plant | |

| Michigan Mercury Rule | Michigan Air Pollution Control Rules, Part 15, Emission Limitations and Prohibitions — Mercury, addressing mercury emissions from coal-fueled electric generating units | |

| Midwest Energy Market | An energy market developed by MISO to provide day-ahead and real-time market information and centralized dispatch for market participants | |

| MISO | The Midwest Independent Transmission System Operator, Inc. | |

| mothball | To place a generating unit into a state of extended reserve shutdown in which the unit is inactive and unavailable for service for a specified period, during which the unit can be brought back into service after receiving appropriate notification and completing any necessary maintenance or other work; generation owners in MISO must request approval to mothball a unit, and MISO then evaluates the request for reliability impacts | |

| MPSC | Michigan Public Service Commission | |

| MRV | Market-related value of plan assets | |

| MW | Megawatt, a unit of power equal to one million watts | |

| MWh | Megawatt-hour, a unit of energy equal to one million watt-hours | |

| NAV | Net asset value | |

| NERC | The North American Electric Reliability Corporation, a non-affiliated company | |

| NOV | Notice of Violation | |

| NPDES | National Pollutant Discharge Elimination System, a permit system for regulating point sources of pollution under the Clean Water Act | |

| NREPA | Part 201 of Michigan Natural Resources and Environmental Protection Act, a statute that covers environmental activities including remediation | |

| NSR | New Source Review, a construction-permitting program under the Clean Air Act | |

| NYMEX | The New York Mercantile Exchange | |

| OPEB | Postretirement benefit plans other than pensions | |

7

| Palisades | Palisades nuclear power plant, sold by Consumers to Entergy in 2007 | |

| Panhandle | Panhandle Eastern Pipe Line Company, including its wholly owned subsidiaries Trunkline, Pan Gas Storage Company, Panhandle Storage Company, and Panhandle Holding Company, a former wholly owned subsidiary of CMS Gas Transmission | |

| PBO | Projected benefit obligation | |

| PCB | Polychlorinated biphenyl | |

| Pension Plan | Trusteed, non-contributory, defined benefit pension plan of CMS Energy, Consumers, and Panhandle | |

| PISP | Performance Incentive Stock Plan | |

| PPA | Power purchase agreement | |

| PSCR | Power supply cost recovery | |

| PSD | Prevention of Significant Deterioration | |

| PURPA | Public Utility Regulatory Policies Act of 1978 | |

| REC | Renewable energy credit established under the 2008 Energy Law | |

| ReliabilityFirst Corporation | ReliabilityFirst Corporation, a non-affiliated company responsible for the preservation and enhancement of bulk power system reliability and security | |

| Renewable Operating Permit | Michigan's Title V permitting program under the Clean Air Act | |

| Right to Work | Legislation enacted in December 2012 as Michigan Public Acts 348 and 349, which prohibits collective bargaining agreements between companies and unions that require employees to join unions and pay union dues in order to maintain their employment | |

| RMRR | Routine maintenance, repair, and replacement | |

| ROA | Retail Open Access, which allows electric generation customers to choose alternative electric suppliers pursuant to the Customer Choice Act | |

| S&P | Standard & Poor's Financial Services LLC | |

| SEC | U.S. Securities and Exchange Commission | |

| Securitization | A financing method authorized by statute and approved by the MPSC which allows a utility to sell its right to receive a portion of the rate payments received from its customers for the repayment of securitization bonds issued by a special-purpose entity affiliated with such utility | |

8

| Sherman Act | Sherman Antitrust Act of 1890 | |

| Smart Energy | Consumers' Smart Energy grid modernization project, which includes the installation of smart meters that transmit and receive data, a two-way communications network, and modifications to Consumers' existing information technology system to manage the data and enable changes to key business processes | |

| stranded costs | Costs such as owned and purchased generation and regulatory assets that are incurred by utilities to serve their customers in a regulated monopoly environment, and which may not be recoverable in a competitive environment because of customers leaving their systems and ceasing to pay for their costs | |

| Superfund | Comprehensive Environmental Response, Compensation, and Liability Act of 1980 | |

| Supplemental Environmental Projects | Environmentally beneficial projects that a party agrees to undertake as part of the settlement of an enforcement action, but which the party is not otherwise legally required to perform | |

| T.E.S. Filer City | T.E.S. Filer City Station Limited Partnership, a VIE in which HYDRA-CO Enterprises, Inc., a wholly owned subsidiary of CMS Enterprises, has a 50 percent interest | |

| Title V | A federal program under the Clean Air Act designed to standardize air quality permits and the permitting process for major sources of emissions across the U.S. | |

| Trunkline | Trunkline Gas Company, LLC, a non-affiliated company | |

| Trust Preferred Securities | Securities representing an undivided beneficial interest in the assets of statutory business trusts, the interests of which have a preference with respect to certain trust distributions over the interests of either CMS Energy or Consumers, as applicable, as owner of the common beneficial interests of the trusts | |

| TSR | Total shareholder return | |

| USW | United Steel, Paper and Forestry, Rubber, Manufacturing, Energy, Allied Industrial and Service Workers International Union, AFL-CIO-CLC | |

| UWUA | Utility Workers Union of America, AFL-CIO | |

| VEBA trust | Voluntary employees' beneficiary association trusts accounts established specifically to set aside employer-contributed assets to pay for future expenses of the OPEB plan | |

| VIE | Variable interest entity | |

| Zeeland | A 935 MW gas-fueled power plant located in Zeeland, Michigan and owned by Consumers |

9

This combined Form 10-K is separately filed by CMS Energy and Consumers. Information in this combined Form 10-K relating to each individual registrant is filed by such registrant on its own behalf. Consumers makes no representation regarding information relating to any other companies affiliated with CMS Energy other than its own subsidiaries. None of CMS Energy, CMS Enterprises, nor any of CMS Energy's other subsidiaries (other than Consumers) has any obligation in respect of Consumers' debt securities and holders of such debt securities should not consider the financial resources or results of operations of CMS Energy, CMS Enterprises, nor any of CMS Energy's other subsidiaries (other than Consumers and its own subsidiaries (in relevant circumstances)) in making a decision with respect to Consumers' debt securities. Similarly, none of Consumers nor any other subsidiary of CMS Energy has any obligation in respect of debt securities of CMS Energy.

FORWARD-LOOKING STATEMENTS AND INFORMATION

This Form 10-K and other written and oral statements that CMS Energy and Consumers make may contain forward-looking statements as defined by the Private Securities Litigation Reform Act of 1995. The use of "might," "may," "could," "should," "anticipates," "believes," "estimates," "expects," "intends," "plans," "projects," "forecasts," "predicts," "assumes," and other similar words is intended to identify forward-looking statements that involve risk and uncertainty. This discussion of potential risks and uncertainties is designed to highlight important factors that may impact CMS Energy's and Consumers' businesses and financial outlook. CMS Energy and Consumers have no obligation to update or revise forward-looking statements regardless of whether new information, future events, or any other factors affect the information contained in the statements. These forward-looking statements are subject to various factors that could cause CMS Energy's and Consumers' actual results to differ materially from the results anticipated in these statements. These factors include, but are not limited to, the following, all of which are potentially significant:

- •

- the impact of regulation by the MPSC or FERC and other applicable governmental proceedings and regulations, including any

associated impact on electric or gas rates or rate structures;

- •

- potentially adverse regulatory treatment or failure to receive timely regulatory orders affecting Consumers that are or

could come before the MPSC, FERC, MISO, or other governmental authorities;

- •

- the adoption of federal or state laws or regulations or changes in applicable laws, rules, regulations, principles, or

practices, or in their interpretation, including those related to energy policy and ROA, the environment, regulation, health care reforms (including the Health Care Acts), taxes, accounting matters,

and other business issues that could have an impact on CMS Energy's or Consumers' businesses or financial results, including laws or regulations regarding climate change and air emissions and

potential effects of the Dodd-Frank Act and related regulations on CMS Energy, Consumers, or any of their affiliates;

- •

- potentially adverse regulatory or legal interpretations or decisions regarding environmental matters, or delayed regulatory treatment or permitting decisions that are or could come before the MDEQ, EPA, and/or U.S. Army Corps of Engineers, and potential environmental remediation costs associated with these interpretations or decisions, including those that may affect Bay Harbor or Consumers' RMRR classification under NSR regulations;

10

- •

- changes in energy markets, including availability and price of electric capacity and the timing and extent of changes in

commodity prices and availability of coal, natural gas, natural gas liquids, electricity, oil, and certain related products;

- •

- the price of CMS Energy common stock, the credit ratings of CMS Energy and Consumers, capital and financial market

conditions, and the effect of these market conditions on CMS Energy's and Consumers' interest costs and access to the capital markets, including availability of financing to CMS Energy, Consumers, or

any of their affiliates;

- •

- the investment performance of the assets of CMS Energy's and Consumers' pension and benefit plans and the discount rates

used in calculating the plans' obligations, and the resulting impact on future funding requirements;

- •

- the impact of the economy, particularly in Michigan, and potential future volatility in the financial and credit markets

on CMS Energy's, Consumers', or any of their affiliates' revenues, ability to collect accounts receivable from customers, or cost and availability of capital;

- •

- changes in the economic and financial viability of CMS Energy's and Consumers' suppliers, customers, and other

counterparties and the continued ability of these third parties, including third parties in bankruptcy, to meet their obligations to CMS Energy and Consumers;

- •

- population changes in the geographic areas where CMS Energy and Consumers conduct business;

- •

- national, regional, and local economic, competitive, and regulatory policies, conditions, and developments;

- •

- loss of customer demand for electric generation supply to alternative energy suppliers;

- •

- federal regulation of electric sales and transmission of electricity, including periodic re-examination by

federal regulators of CMS Energy's and Consumers' market-based sales authorizations in wholesale power markets without price restrictions;

- •

- the impact of credit markets, economic conditions, and any new banking regulations on EnerBank;

- •

- the availability, cost, coverage, and terms of insurance, the stability of insurance providers, and the ability of

Consumers to recover the costs of any insurance from customers;

- •

- the effectiveness of CMS Energy's and Consumers' risk management policies, procedures, and strategies, including

strategies to hedge risk related to future prices of electricity, natural gas, and other energy-related commodities;

- •

- factors affecting development of electric generation projects and distribution infrastructure replacement and expansion projects, including those related to project site identification, construction material pricing, availability of qualified construction personnel, permitting, and government approvals;

11

- •

- factors affecting operations, such as costs and availability of personnel, equipment, and materials, unusual weather

conditions, catastrophic weather-related damage, scheduled or unscheduled equipment outages, maintenance or repairs, environmental incidents, and electric transmission and distribution or gas pipeline

system constraints;

- •

- potential disruption to, interruption of, or other impacts on facilities, utility infrastructure, or operations due to

accidents, explosions, physical disasters, war, or terrorism, and the ability to obtain or maintain insurance coverage for these events;

- •

- changes or disruption in fuel supply, including but not limited to rail or vessel transport of coal and pipeline transport

of natural gas;

- •

- potential costs, lost revenues, or other consequences resulting from misappropriation of assets or sensitive information,

corruption of data, or operational disruption in connection with a cyber attack or other cyber incident;

- •

- technological developments in energy production, storage, delivery, usage, and metering, including Smart Energy and the

success of its implementation;

- •

- the impact of CMS Energy's and Consumers' integrated business software system and its operation on their activities,

including utility customer billing and collections;

- •

- adverse consequences resulting from any past or future assertion of indemnity or warranty claims associated with assets

and businesses previously owned by CMS Energy or Consumers, including claims resulting from attempts by foreign or domestic governments to assess taxes on past operations or transactions;

- •

- the outcome, cost, and other effects of legal or administrative proceedings, settlements, investigations, or claims;

- •

- restrictions imposed by various financing arrangements and regulatory requirements on the ability of Consumers and other

subsidiaries of CMS Energy to transfer funds to CMS Energy in the form of cash dividends, loans, or advances;

- •

- earnings volatility resulting from the application of fair value accounting to certain energy commodity contracts, such as

electricity sales agreements and interest rate and foreign currency contracts;

- •

- changes in financial or regulatory accounting principles or policies, including a possible future requirement to comply

with International Financial Reporting Standards, which differ from GAAP in various ways, including the present lack of special accounting treatment for regulated activities; and

- •

- other matters that may be disclosed from time to time in CMS Energy's and Consumers' SEC filings, or in other publicly issued documents.

For additional details regarding these and other uncertainties, see Item 1A. Risk Factors; Item 8. Financial Statements and Supplementary Data, MD&A – Outlook; and Item 8. Financial Statements and Supplementary Data, Notes to the Consolidated Financial Statements – Note 3, Regulatory Matters and Note 4, Contingencies and Commitments.

12

GENERAL

CMS ENERGY

CMS Energy was formed as a corporation in Michigan in 1987 and is an energy company operating primarily in Michigan. It is the parent holding company of several subsidiaries, including Consumers, an electric and gas utility, and CMS Enterprises, primarily a domestic independent power producer. Consumers serves individuals and businesses operating in the alternative energy, automotive, chemical, metal, and food products industries, as well as a diversified group of other industries. CMS Enterprises, through its subsidiaries and equity investments, is engaged primarily in independent power production and owns power generation facilities fueled mostly by natural gas and biomass.

CMS Energy manages its businesses by the nature of services each provides and operates, principally in three business segments: electric utility, gas utility, and enterprises, its non-utility operations and investments. Consumers' consolidated operations account for substantially all of CMS Energy's total assets, income, and operating revenue. CMS Energy's consolidated operating revenue was $6.3 billion in 2012, $6.5 billion in 2011, and $6.4 billion in 2010.

For further information about operating revenue, net operating income, and identifiable assets and liabilities attributable to all of CMS Energy's business segments and operations, see Item 8. Financial Statements and Supplementary Data, CMS Energy's Selected Financial Information, Consolidated Financial Statements, and Notes to the Consolidated Financial Statements.

CONSUMERS

Consumers has served Michigan customers since 1886. Consumers was incorporated in Maine in 1910 and became a Michigan corporation in 1968. Consumers owns and operates electric distribution and generation facilities and gas transmission, storage, and distribution facilities. It provides electricity and/or natural gas to 6.6 million of Michigan's 10 million residents. Consumers' rates and certain other aspects of its business are subject to the jurisdiction of the MPSC and FERC, as described in "CMS Energy and Consumers Regulation" in this Item 1.

Consumers' consolidated operating revenue was $6.0 billion in 2012, $6.3 billion in 2011, and $6.2 billion in 2010. For further information about operating revenue, net operating income, and identifiable assets and liabilities attributable to Consumers' electric and gas utility operations, see Item 8. Financial Statements and Supplementary Data, Consumers' Selected Financial Information, Consolidated Financial Statements, and Notes to the Consolidated Financial Statements.

Consumers owns its principal properties in fee, except that most electric lines and gas mains are located below public roads or on land owned by others and are accessed by Consumers through easements and other rights. Almost all of Consumers' properties are subject to the lien of its First Mortgage Bond Indenture. For additional information on Consumers' properties, see Consumers Electric Utility – Electric Utility Properties and Consumers Gas Utility – Gas Utility Properties in the "Business Segments" section of this Item 1.

13

In 2012, Consumers served 1.8 million electric customers and 1.7 million gas customers in Michigan's Lower Peninsula. Presented in the following map is Consumers' service territory:

14

BUSINESS SEGMENTS

CONSUMERS ELECTRIC UTILITY

Electric Utility Operations: Consumers' electric utility operations, which include the generation, purchase, distribution, and sale of electricity, generated operating revenue of $4.0 billion in 2012, $3.9 billion in 2011, and $3.8 billion in 2010. Consumers' electric utility customer base consists of a mix of residential, commercial, and diversified industrial customers in Michigan's Lower Peninsula.

Presented in the following illustration is Consumers' 2012 electric utility operating revenue of $4.0 billion by customer class:

Consumers' electric utility operations are not dependent on a single customer, or even a few customers, and the loss of any one or even a few of Consumers' largest customers is not reasonably likely to have a material adverse effect on Consumers' financial condition.

In each of 2012 and 2011, Consumers' electric deliveries were 38 billion kWh, which included ROA deliveries of four billion kWh, resulting in net bundled sales of 34 billion kWh.

Consumers' electric utility operations are seasonal. The consumption of electric energy typically increases in the summer months, due primarily to the use of air conditioners and other cooling equipment.

15

Presented in the following illustration are Consumers' monthly weather-adjusted electric deliveries (deliveries adjusted to reflect normal weather conditions) to its customers, including ROA deliveries, during 2012 and 2011:

Consumers' 2012 summer peak demand was 9,006 MW, which included ROA demand of 619 MW. For the 2011-2012 winter period, Consumers' peak demand was 5,864 MW, which included ROA demand of 500 MW. As required by MISO reserve margin requirements, Consumers owns or controls, through long-term contracts, capacity required to supply most of its projected firm peak load and necessary reserve margin for summer 2013. Consumers expects to acquire the balance of its 2013 requirements through MISO's forward capacity auction scheduled to be conducted in April 2013.

Electric Utility Properties: Consumers' distribution system includes:

- •

- 421 miles of high-voltage distribution radial lines operating at 120 kilovolts or above;

- •

- 4,259 miles of high-voltage distribution overhead lines operating at 23 kilovolts, 46 kilovolts, and 69 kilovolts;

- •

- 17 miles of high-voltage distribution underground lines operating at 23 kilovolts and 46 kilovolts;

- •

- 55,965 miles of electric distribution overhead lines;

- •

- 10,162 miles of underground distribution lines; and

- •

- substations with an aggregate transformer capacity of 24 million kVA.

16

Consumers is interconnected to the interstate high-voltage electric transmission system owned by Michigan Electric Transmission Company, LLC, a non-affiliated company, and operated by MISO, to neighboring utilities, and to other transmission systems.

At December 31, 2012, Consumers' electric generating system consisted of the following:

Name and Location (Michigan) |

Number of Units and Year Entered Service |

2012 Generation Capacity1 (MW) |

2012 Net Generation (GWh) |

||||||

| Coal generation | |||||||||

J.H. Campbell 1 & 2 – West Olive |

2 Units, 1962-1967 | 615 | 2,747 | ||||||

J.H. Campbell 3 – West Olive2 |

1 Unit, 1980 | 770 | 4,606 | ||||||

B.C. Cobb 4 & 5 – Muskegon3 |

2 Units, 1956-1957 | 312 | 1,564 | ||||||

D.E. Karn 1 & 2 – Essexville |

2 Units, 1959-1961 | 515 | 2,200 | ||||||

J.C. Weadock 7 & 8 – Essexville3 |

2 Units, 1955-1958 | 310 | 1,566 | ||||||

J.R. Whiting 1-3 – Erie3 |

3 Units, 1952-1953 | 324 | 1,344 | ||||||

| Total coal generation | 2,846 | 14,027 | |||||||

| Oil/Gas steam generation | |||||||||

B.C. Cobb 1-3 – Muskegon |

3 Units, 1999-20004 | – | – | ||||||

D.E. Karn 3 & 4 – Essexville |

2 Units, 1975-1977 | 1,276 | 82 | ||||||

Zeeland (combined cycle) – Zeeland |

1 Unit, 2002 | 519 | 2,537 | ||||||

| Total oil/gas steam generation | 1,795 | 2,619 | |||||||

| Hydroelectric | |||||||||

Conventional hydro generation |

13 Plants, 1906-1949 | 76 | 399 | ||||||

Ludington – Ludington |

6 Units, 1973 | 954 | 5 | (295 | )6 | ||||

| Total hydroelectric | 1,030 | 104 | |||||||

| Gas/Oil combustion turbine | |||||||||

Various plants |

7 Plants, 1966-1971 | 40 | 5 | ||||||

Zeeland (simple cycle) – Zeeland |

2 Units, 2001 | 308 | 385 | ||||||

| Total gas/oil combustion turbine | 348 | 390 | |||||||

| Wind generation | |||||||||

Lake Winds® Energy Park7 |

56 Turbines, 2012 | 100 | 34 | ||||||

| Total wind generation | 100 | 34 | |||||||

| Total owned generation | 6,119 | 17,174 | |||||||

| Purchased and interchange power8 | 2,488 | 9 | 18,690 | 10 | |||||

| Total supply | 8,607 | 35,864 | |||||||

| Generation and transmission use/loss | (1,761 | ) | |||||||

| Total net bundled sales | 34,103 | ||||||||

- 1

- Represents

each plant's electric generation capacity during the summer months, except for Lake Winds® Energy Park, which began

operations in November 2012.

- 2

- Represents

Consumers' share of the capacity of the J.H. Campbell 3 unit, net of the 6.69 percent ownership interest of the

Michigan Public Power Agency and Wolverine Power Supply Cooperative, Inc.

- 3

- In December 2011, Consumers announced its plans to mothball seven smaller coal-fueled generating units in 2015. For further information, see Item 8. Financial Statements and Supplementary Data,

17

- 4

- B.C. Cobb

1-3 are retired coal-fueled units that were converted to gas-fueled units. B.C. Cobb

1-3 were placed back into service in the years indicated, and subsequently mothballed beginning in April 2009. Consumers has received an extension of the mothball period to April 2013 and

plans to request a further extension of the mothball period through September 2015.

- 5

- Represents

Consumers' 51 percent share of the capacity of Ludington. DTE Electric owns the remaining 49 percent.

- 6

- Represents

Consumers' share of net pumped-storage generation. The pumped-storage facility consumes electricity to pump water during

off-peak hours for storage in order to generate electricity later during peak-demand hours.

- 7

- Wind

generation is an intermittent resource and as a result, the capacity credit associated with wind resources located in the MISO service area

is less than the generation nameplate capacity. The capacity credit for Lake Winds® Energy Park is 13 MW for 2013.

- 8

- Includes

purchases from the Midwest Energy Market, long-term purchase contracts, and seasonal purchases.

- 9

- Includes

1,240 MW of purchased contract capacity from the MCV Facility and 778 MW of purchased contract capacity from Palisades.

- 10

- Includes 4,555 GWh of purchased energy from the MCV Facility and 6,875 GWh of purchased energy from Palisades.

MD&A – Outlook, "Consumers Electric Utility Business Outlook and Uncertainties – Balanced Energy Initiative."

As shown in the following illustration, Consumers' 2012 generation capacity of 8,607 MW, including purchased capacity of 2,488 MW, relied on a variety of fuel sources:

18

Consumers generated power from the following sources:

GWh |

||||||||||||||||

Net Generation |

2012 | 2011 | 2010 | 2009 | 2008 | |||||||||||

Owned generation |

||||||||||||||||

Coal |

14,027 | 15,468 | 17,879 | 17,255 | 17,701 | |||||||||||

Gas |

3,003 | 1,912 | 1,043 | 565 | 804 | |||||||||||

Renewable energy |

433 | 425 | 365 | 466 | 454 | |||||||||||

Oil |

6 | 7 | 21 | 14 | 41 | |||||||||||

Net pumped storage1 |

(295 | ) | (365 | ) | (366 | ) | (303 | ) | (382 | ) | ||||||

Total owned generation |

17,174 | 17,447 | 18,942 | 17,997 | 18,618 | |||||||||||

Purchased and interchange power |

||||||||||||||||

Purchased renewable energy2 |

1,435 | 1,587 | 1,582 | 1,472 | 1,503 | |||||||||||

Purchased generation – other2 |

13,104 | 11,087 | 10,421 | 10,066 | 12,140 | |||||||||||

Net interchange power3 |

4,151 | 6,825 | 6,045 | 6,925 | 6,653 | |||||||||||

Total purchased and interchange power |

18,690 | 19,499 | 18,048 | 18,463 | 20,296 | |||||||||||

Total supply |

35,864 | 36,946 | 36,990 | 36,460 | 38,914 | |||||||||||

- 1

- Represents

Consumers' share of net pumped-storage generation. The pumped-storage facility consumes electricity to pump water during

off-peak hours for storage in order to generate electricity later during peak-demand hours.

- 2

- Includes

purchases from long-term purchase contracts.

- 3

- Includes purchases from the Midwest Energy Market and seasonal purchases.

The cost of all fuels consumed, shown in the following table, fluctuates with the mix of fuel used.

Cost Per Million Btu |

||||||||||

Fuel Consumed |

2012 | 2011 | 2010 | 2009 | 2008 | |||||

Coal |

$ 2.98 | $ 2.94 | $ 2.51 | $ 2.37 | $ 2.01 | |||||

Gas |

3.16 | 4.95 | 5.57 | 6.57 | 10.94 | |||||

Oil |

19.08 | 18.55 | 10.98 | 9.59 | 11.54 | |||||

All fuels1 |

$ 3.05 | $ 3.18 | $ 2.71 | $ 2.56 | $ 2.47 | |||||

- 1

- Weighted-average fuel costs

In 2012, Consumers' four coal-fueled generating sites burned 8 million tons of coal and produced a combined total of 14,027 GWh of electricity, which represented 39 percent of the energy provided by Consumers to meet customer demand.

In order to obtain its coal requirements, Consumers enters into physical coal supply contracts. At December 31, 2012, Consumers had contracts to purchase coal through 2015; payment obligations under these contracts totaled $214 million. All of Consumers' coal supply contracts have fixed prices. At December 31, 2012, Consumers had 78 percent of its 2013 expected coal requirements under contract, as well as a 45-day supply of coal on hand.

19

In conjunction with its coal supply contracts, Consumers leases a fleet of rail cars and has long-term transportation contracts with various companies to provide rail and vessel services for delivery of purchased coal to Consumers' generating facilities. Consumers' coal transportation contracts expire from 2013 through 2014; payment obligations under these contracts totaled $238 million.

During 2012, Consumers purchased 52 percent of the electricity it provided to customers through long-term PPAs, seasonal purchases, and the Midwest Energy Market. Consumers offers its generation into the Midwest Energy Market on a day-ahead and real-time basis and bids for power in the market to serve the demand of its customers. Consumers is a net purchaser of power and supplements its generation capability with purchases from the Midwest Energy Market to meet its customers' needs during peak demand periods.

At December 31, 2012, Consumers had unrecognized future commitments (amounts for which liabilities, in accordance with GAAP, have not been recorded on its balance sheet) to purchase capacity and energy under long-term PPAs with various generating plants. These contracts require monthly capacity payments based on the plants' availability or deliverability. The payments for 2013 through 2040 total $12.5 billion and range from $911 million to $964 million annually for each of the next five years. These amounts may vary depending on plant availability and fuel costs. For further information about Consumers' future capacity and energy purchase obligations, see Item 8. Financial Statements and Supplementary Data, MD&A — Capital Resources and Liquidity and Note 4, Contingencies and Commitments — Contractual Commitments.

Electric Utility Competition: Consumers' electric utility business is subject to actual and potential competition from many sources, in both the wholesale and retail markets, as well as in electric generation, electric delivery, and retail services.

The Customer Choice Act allows all of Consumers' electric customers to buy electric generation service from Consumers or from an alternative electric supplier. The 2008 Energy Law revised the Customer Choice Act by limiting alternative electric supply to ten percent of weather-adjusted retail sales for the preceding calendar year. At December 31, 2012, electric deliveries under the ROA program were at the ten percent limit. Alternative electric suppliers were providing 777 MW of generation service to ROA customers.

Consumers also has competition or potential competition from:

- •

- industrial customers relocating all or a portion of their production capacity outside Consumers' service territory for economic reasons;

- •

- municipalities owning or operating competing electric delivery systems; and

- •

- customer self-generation.

Consumers addresses this competition by monitoring activity in adjacent areas and monitoring compliance with the MPSC's and FERC's rules, providing non-energy services, providing value to customers through Consumers' rates and service, and offering tariff-based incentives that support economic development.

CONSUMERS GAS UTILITY

Gas Utility Operations: Consumers' gas utility operations, which include the purchase, transmission, storage, distribution, and sale of natural gas, generated operating revenue of

20

$2.0 billion in 2012, $2.3 billion in 2011, and $2.4 billion in 2010. Consumers' gas utility customer base consists of a mix of residential, commercial, and diversified industrial customers in Michigan's Lower Peninsula.

Presented in the following illustration is Consumers' 2012 gas utility operating revenue of $2.0 billion by customer class:

Consumers' gas utility operations are not dependent on a single customer, or even a few customers, and the loss of any one or even a few of Consumers' largest customers is not reasonably likely to have a material adverse effect on Consumers' financial condition.

In 2012, deliveries of natural gas, including off-system transportation deliveries, through Consumers' pipeline and distribution network, totaled 329 bcf, which included GCC deliveries of 49 bcf. In 2011, deliveries of natural gas, including off-system transportation deliveries, through Consumers' pipeline and distribution network, totaled 337 bcf, which included GCC deliveries of 48 bcf. Consumers' gas utility operations are seasonal. Consumers injects natural gas into storage during the summer months for use during the winter months when the demand for natural gas is higher. Peak demand occurs in the winter due to colder temperatures and the resulting use of natural gas as a heating fuel. During 2012, 42 percent of the natural gas supplied to all customers during the winter months was supplied from storage.

21

Presented in the following illustration are Consumers' monthly weather-adjusted gas deliveries to its customers, including GCC deliveries, during 2012 and 2011:

Gas Utility Properties: Consumers' gas distribution and transmission system located in Michigan's Lower Peninsula consists of:

- •

- 26,720 miles of distribution mains;

- •

- 1,657 miles of transmission lines;

- •

- seven compressor stations with a total of 151,172 installed and available horsepower; and

- •

- 15 gas storage fields with an aggregate storage capacity of 309 bcf and a working storage capacity of 143 bcf.

22

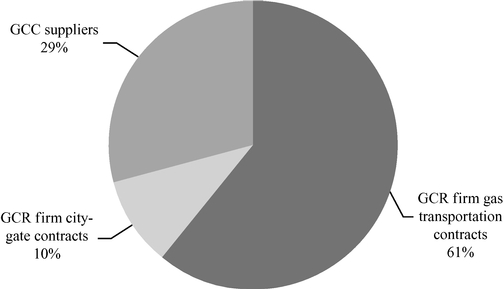

Gas Utility Supply: In 2012, Consumers purchased 62 percent of the gas it delivered from U.S. producers and 9 percent from Canadian producers. The remaining 29 percent was purchased from authorized GCC suppliers and delivered by Consumers to customers in the GCC program. Presented in the following illustration are the supply arrangements for the gas Consumers delivered to GCC and GCR customers during 2012:

Firm transportation or firm city-gate contracts are those that define a fixed amount, price, and delivery time frame. Consumers' firm gas transportation contracts are with ANR Pipeline Company, Great Lakes Gas Transmission, L.P., Panhandle, and Trunkline. Under these contracts, Consumers purchases and transports gas to Michigan for ultimate delivery to its customers. Consumers' firm gas transportation contracts expire through 2017 and provide for the delivery of 75 percent of Consumers' total gas supply requirements. Consumers purchases the balance of its required gas supply under firm city-gate contracts and through authorized suppliers under the GCC program.

Gas Utility Competition: Competition exists in various aspects of Consumers' gas utility business. Competition comes from other gas suppliers taking advantage of direct access to Consumers' customers (GCC) and from alternative fuels and energy sources, such as propane, oil, and electricity.

ENTERPRISES SEGMENT – NON-UTILITY OPERATIONS AND INVESTMENTS

CMS Energy's enterprises segment, through various subsidiaries and certain equity investments, is engaged primarily in domestic independent power production and the marketing of independent power production. The enterprises segment's operating revenue included in income from continuing operations in CMS Energy's consolidated financial statements was $183 million in 2012, $204 million in 2011, and $238 million in 2010. The enterprises segment's operating revenue included in income (loss) from discontinued operations in CMS Energy's consolidated financial statements was less than $1 million in 2011 and was $10 million in 2010.

23

Independent Power Production: At December 31, 2012, CMS Energy had ownership interests in independent power plants totaling 1,135 gross MW or 1,034 net MW. (Net MW reflects that portion of the gross capacity relating to CMS Energy's ownership interests.) Presented in the following table are CMS Energy's interests in independent power plants at December 31, 2012:

Location |

Primary Fuel Type |

Ownership Interest (%) |

Gross Capacity (MW) |

Gross Capacity Under Long-Term Contract (%) |

||||||||

Dearborn, Michigan |

Natural gas | 100 | 710 | 39 | ||||||||

Gaylord, Michigan |

Natural gas | 100 | 156 | 47 | ||||||||

Comstock, Michigan |

Natural gas | 100 | 68 | 47 | ||||||||

Filer City, Michigan |

Coal | 50 | 73 | 100 | ||||||||

Flint, Michigan |

Biomass | 50 | 40 | 100 | ||||||||

Grayling, Michigan |

Biomass | 50 | 38 | 100 | ||||||||

New Bern, North Carolina |

Biomass | 50 | 50 | 100 | ||||||||

Total |

1,135 | |||||||||||

The operating revenue from independent power production included in income from continuing operations in CMS Energy's consolidated financial statements was $16 million in 2012, $17 million in 2011, and $18 million in 2010. The operating revenue from independent power production included in income (loss) from discontinued operations in CMS Energy's consolidated financial statements was less than $1 million in 2011 and was $10 million in 2010. CMS Energy's independent power production business faces competition from generators, marketers and brokers, and utilities marketing power in the wholesale market.

Energy Resource Management: CMS ERM purchases and sells energy commodities in support of CMS Energy's generating facilities and continues to focus on optimizing CMS Energy's independent power production portfolio. In 2012, CMS ERM marketed 13 bcf of natural gas and 4,591 GWh of electricity. Electricity marketed by CMS ERM was generated by independent power production of the enterprises segment and unrelated third parties. CMS ERM's operating revenue included in income from continuing operations in CMS Energy's consolidated financial statements was $167 million in 2012, $187 million in 2011, and $220 million in 2010.

OTHER BUSINESSES

EnerBank: EnerBank, a wholly owned subsidiary of CMS Energy, is a Utah state-chartered, FDIC-insured industrial bank providing unsecured consumer installment loans for financing home improvements. EnerBank's operating revenue included in income from continuing operations in CMS Energy's consolidated financial statements was $57 million in 2012, $46 million in 2011, and $38 million in 2010.

CMS ENERGY AND CONSUMERS REGULATION

CMS Energy, Consumers, and their subsidiaries are subject to regulation by various federal, state, local, and foreign governmental agencies, including those described in the following sections.

24

FERC

FERC has exercised limited jurisdiction over several independent power plants and exempt wholesale generators in which CMS Enterprises has ownership interests, as well as over CMS ERM, CMS Gas Transmission, and DIG. Among other things, FERC has jurisdiction over acquisitions, operations, and disposals of certain assets and facilities, services provided and rates charged, conduct among affiliates, and limited jurisdiction over holding company matters with respect to CMS Energy. FERC, in connection with NERC and with regional reliability organizations, also regulates generation owners and operators, load serving entities, purchase and sale entities, and others with regard to reliability of the bulk power system. FERC regulates limited aspects of Consumers' gas business, principally compliance with FERC capacity release rules, shipping rules, the prohibition against certain buy/sell transactions, and the price-reporting rule.

FERC also regulates certain aspects of Consumers' electric operations, including compliance with FERC accounting rules, wholesale rates, operation of licensed hydroelectric generating plants, transfers of certain facilities, corporate mergers, and issuances of securities.

MPSC

Consumers is subject to the jurisdiction of the MPSC, which regulates public utilities in Michigan with respect to retail utility rates, accounting, utility services, certain facilities, corporate mergers, and other matters.

The Michigan Attorney General, ABATE, the MPSC Staff, and certain other parties typically participate in MPSC proceedings concerning Consumers. The Michigan Attorney General, ABATE, and others often appeal significant MPSC orders.

Rate Proceedings: For information regarding open rate proceedings, see Item 8. Financial Statements and Supplementary Data, Notes to the Consolidated Financial Statements, Note 3, Regulatory Matters.

OTHER REGULATION

The U.S. Secretary of Energy regulates imports and exports of natural gas and has delegated various aspects of this jurisdiction to FERC and the DOE's Office of Fossil Fuels.

The U.S. Department of Transportation Office of Pipeline Safety regulates the safety and security of gas pipelines through the Natural Gas Pipeline Safety Act of 1968 and subsequent laws.

EnerBank is regulated by the State of Utah and the FDIC.

ENERGY LEGISLATION

CMS Energy, Consumers, and their subsidiaries are subject to various legislative-driven matters, including Michigan's 2008 Energy Law. This law requires that at least ten percent of Consumers' electric sales volume come from renewable energy sources by 2015, and includes requirements for specific capacity additions. The 2008 Energy Law also requires Consumers to prepare an energy optimization plan and achieve annual sales reduction targets through at least 2015. The targets are incremental with the goal of achieving a six percent reduction in customers'

25

electricity use and a four percent reduction in customers' natural gas use by December 31, 2015. The 2008 Energy Law also reformed the Customer Choice Act to limit alternative energy suppliers to supplying no more than ten percent of Consumers' weather-adjusted sales. For additional information regarding Consumers' renewable energy and energy optimization plans and the Customer Choice Act, see Item 8. Financial Statements and Supplementary Data, MD&A, Outlook, "Consumers Electric Utility Business Outlook and Uncertainties."

CMS ENERGY AND CONSUMERS ENVIRONMENTAL COMPLIANCE

CMS Energy, Consumers, and their subsidiaries are subject to various federal, state, and local regulations for environmental quality, including air and water quality, solid waste management, and other matters. For additional information concerning environmental matters, see Item 1A. Risk Factors and Item 8. Financial Statements and Supplementary Data, Notes to the Consolidated Financial Statements, Note 4, Contingencies and Commitments.

CMS Energy has recorded a significant liability for its affiliates' obligations associated with Bay Harbor and Consumers has recorded a significant liability for its obligations at a number of MGP sites. For additional information, see Item 1A. Risk Factors and Item 8. Financial Statements and Supplementary Data, Notes to the Consolidated Financial Statements, Note 4, Contingencies and Commitments.

Air: Consumers continues to install state-of-the-art emissions control equipment at its electric generating plants and to convert electric generating units to burn cleaner fuels. Consumers estimates that it will incur expenditures of $835 million from 2013 through 2018 to comply with present and future federal and state regulations that will require extensive reductions in nitrogen oxides, sulfur dioxides, particulate matter, and mercury emissions. Consumers' estimate may increase if additional or more stringent laws or regulations are adopted or implemented regarding greenhouse gases, including carbon dioxide.

Solid Waste Disposal: Costs related to the construction, operation, and closure of solid waste disposal facilities for coal ash are significant. Historically, Consumers has worked with others to reuse 30 to 50 percent of ash produced by its coal-fueled plants, and sells ash for use as a Portland cement replacement in concrete products, as feedstock for the manufacture of Portland cement, and for other environmentally sustainable uses. Consumers' solid waste disposal areas are regulated under Michigan's solid waste rules. Consumers has converted all of its fly ash handling systems to dry systems. All of Consumers' ash facilities have programs designed to protect the environment and are subject to quarterly MDEQ inspections. The EPA has proposed new federal regulations for ash disposal areas. Consumers preliminarily estimates that it will incur expenditures of $125 million from 2013 through 2018 to comply with future regulations relating to ash disposal, assuming ash is regulated as a non-hazardous solid waste.

Water: Consumers uses significant amounts of water to operate and cool its electric generating plants. Water discharge quality is regulated and administered by the MDEQ under the federal NPDES program. To comply with such regulation, Consumers' facilities have discharge monitoring programs. The EPA is developing new regulations related to cooling water intake systems, but these new regulations are not expected to take effect until after 2018. Accordingly, Consumers does not presently expect to incur any significant expenditures to comply with future regulations relating to cooling water intake systems through 2018. Significant expenditures could be required beyond 2018, but until a rule is final, any potential expenditures are difficult to predict. Consumers also expects the EPA to propose new federal regulations for wastewater discharges from electric generating plants in 2013, with a final rule in 2014. Consumers'

26

preliminary estimate of expenditures to comply with these expected regulations is $180 million from 2013 through 2018.

For further information concerning estimated capital expenditures related to air, solid waste disposal, and water see Item 8. Financial Statements and Supplementary Data, MD&A, Outlook, "Consumers Electric Utility Business Outlook and Uncertainties – Electric Environmental Estimates."

INSURANCE

CMS Energy and its subsidiaries, including Consumers, maintain insurance coverage generally similar to comparable companies in the same lines of business. The insurance policies are subject to terms, conditions, limitations, and exclusions that might not fully compensate CMS Energy or Consumers for all losses. A portion of each loss is generally assumed by CMS Energy or Consumers in the form of deductibles and self-insured retentions that, in some cases, are substantial. As CMS Energy or Consumers renews its policies, it is possible that some of the present insurance coverage may not be renewed or obtainable on commercially reasonable terms due to restrictive insurance markets.

CMS Energy's and Consumers' present insurance program does not cover the risks of certain environmental cleanup costs and environmental damages, such as claims for air pollution, damage to sites owned by CMS Energy or Consumers, and some long-term storage or disposal of wastes.

EMPLOYEES

Presented in the following table are the number of employees of CMS Energy and Consumers:

December 31 |

2012 | 2011 | 2010 | |||||||

CMS Energy, including Consumers |

||||||||||

Number of full-time-equivalent employees |

7,514 | 7,727 | 7,822 | |||||||

Consumers |

||||||||||

Number of full-time-equivalent employees |

7,205 | 7,435 | 7,522 | |||||||

27

CMS ENERGY EXECUTIVE OFFICERS (AS OF FEBRUARY 1, 2013)

Name |

Age | Position | Period | |||

John G. Russell |

55 | President and CEO of CMS Energy | 5/2010-Present | |||

|

President and CEO of Consumers | 5/2010-Present | ||||

|

Director of CMS Energy | 5/2010-Present | ||||

|

Director of Consumers | 5/2010-Present | ||||

|

Director of CMS Enterprises | 5/2010-Present | ||||

|

Chairman of the Board, President, and CEO of CMS Enterprises | 5/2010-Present | ||||

|

President and Chief Operating Officer of Consumers | 10/2004-5/2010 | ||||

|

||||||

Thomas J. Webb |

60 | Executive Vice President and CFO of CMS Energy | 8/2002-Present | |||

|

Executive Vice President and CFO of Consumers | 8/2002-Present | ||||

|

Executive Vice President and CFO of CMS Enterprises | 8/2002-Present | ||||

|

Director of CMS Enterprises | 8/2002-Present | ||||

|

||||||

James E. Brunner |

60 | Senior Vice President and General Counsel of CMS Energy | 2/2006-Present | |||

|

Senior Vice President and General Counsel of Consumers | 2/2006-Present | ||||

|

Senior Vice President and General Counsel of CMS Enterprises | 11/2007-Present | ||||

|

Director of CMS Enterprises | 9/2006-Present | ||||

|

||||||

John M. Butler |

48 | Senior Vice President of CMS Energy | 7/2006-Present | |||

|

Senior Vice President of Consumers | 7/2006-Present | ||||

|

Senior Vice President of CMS Enterprises | 9/2006-Present | ||||

|

||||||

David G. Mengebier |

55 | Senior Vice President and Chief Compliance Officer of CMS Energy | 11/2006-Present | |||

|

Senior Vice President and Chief Compliance Officer of Consumers | 11/2006-Present | ||||

|

Senior Vice President of CMS Enterprises | 3/2003-Present | ||||

|

||||||

Glenn P. Barba |

47 | Vice President, Controller, and CAO of CMS Energy | 2/2003-Present | |||

|

Vice President, Controller, and CAO of Consumers | 1/2003-Present | ||||

|

Vice President, Controller, and CAO of CMS Enterprises | 11/2007-Present | ||||

There are no family relationships among executive officers and directors of CMS Energy.

The term of office of each of the executive officers extends to the first meeting of the Board of Directors of CMS Energy after the next annual election of Directors of CMS Energy (scheduled to be held on May 17, 2013).

28

CONSUMERS EXECUTIVE OFFICERS (AS OF FEBRUARY 1, 2013)

Name |

Age | Position | Period | |||

John G. Russell |

55 | President and CEO of CMS Energy | 5/2010-Present | |||

|

President and CEO of Consumers | 5/2010-Present | ||||

|

Director of CMS Energy | 5/2010-Present | ||||

|

Director of Consumers | 5/2010-Present | ||||

|

Director of CMS Enterprises | 5/2010-Present | ||||

|

Chairman of the Board, President, and CEO of CMS Enterprises | 5/2010-Present | ||||

|

President and Chief Operating Officer of Consumers | 10/2004-5/2010 | ||||

|

||||||

Thomas J. Webb |

60 | Executive Vice President and CFO of CMS Energy | 8/2002-Present | |||

|

Executive Vice President and CFO of Consumers | 8/2002-Present | ||||

|

Executive Vice President and CFO of CMS Enterprises | 8/2002-Present | ||||

|

Director of CMS Enterprises | 8/2002-Present | ||||

|

||||||

James E. Brunner |

60 | Senior Vice President and General Counsel of CMS Energy | 2/2006-Present | |||

|

Senior Vice President and General Counsel of Consumers | 2/2006-Present | ||||

|

Senior Vice President and General Counsel of CMS Enterprises | 11/2007-Present | ||||

|

Director of CMS Enterprises | 9/2006-Present | ||||

|

||||||

John M. Butler |

48 | Senior Vice President of CMS Energy | 7/2006-Present | |||

|

Senior Vice President of Consumers | 7/2006-Present | ||||

|

Senior Vice President of CMS Enterprises | 9/2006-Present | ||||

|

||||||

David G. Mengebier |

55 | Senior Vice President and Chief Compliance Officer of CMS Energy | 11/2006-Present | |||

|

Senior Vice President and Chief Compliance Officer of Consumers | 11/2006-Present | ||||

|

Senior Vice President of CMS Enterprises | 3/2003-Present | ||||

|

||||||

Jackson L. Hanson |

56 | Senior Vice President of Consumers | 5/2010-Present | |||

|

Vice President of Consumers | 11/2006-5/2010 | ||||

|

||||||

Daniel J. Malone |

52 | Senior Vice President of Consumers | 5/2010-Present | |||

|

Vice President of Consumers | 6/2008-5/2010 | ||||

|

Site Business Manager of Consumers | 12/2006-6/2008 | ||||

|

||||||

Glenn P. Barba |

47 | Vice President, Controller, and CAO of CMS Energy | 2/2003-Present | |||

|

Vice President, Controller, and CAO of Consumers | 1/2003-Present | ||||

|

Vice President, Controller, and CAO of CMS Enterprises | 11/2007-Present | ||||

There are no family relationships among executive officers and directors of Consumers.

The term of office of each of the executive officers extends to the first meeting of the Board of Directors of Consumers after the next annual election of Directors of Consumers (scheduled to be held on May 17, 2013).

29

AVAILABLE INFORMATION

CMS Energy's internet address is www.cmsenergy.com. Information contained on CMS Energy's website is not incorporated herein. All of CMS Energy's annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed pursuant to Section 13(a) or 15(d) of the Exchange Act are accessible free of charge on CMS Energy's website. These reports are available soon after they are filed electronically with the SEC. Also on CMS Energy's website are its:

- •

- Corporate Governance Principles;

- •

- Codes of Conduct:

- •

- CMS Energy Corporation/Consumers Energy Company Board of Directors Code of Conduct – January 2013,

- •

- Code of Conduct and Guide to Ethical Business Behavior 2010,

- •

- Guide to Ethical Business Behavior Addendum – March 1, 2011, and

- •

- Guide to Ethical Business Behavior Addendum – January 24, 2013;

- •

- Board Committee Charters (including the Audit Committee, the Compensation and Human Resources Committee, the Finance Committee, and the Governance and Public Responsibility Committee); and

- •

- Articles of Incorporation (and amendments) and Bylaws.

CMS Energy will provide this information in print to any stockholder who requests it.

Any materials CMS Energy files with the SEC may also be read and copied at the SEC's Public Reference Room at 100 F Street, N.E., Washington D.C., 20549. Information on the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330. The SEC also maintains an internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The address is www.sec.gov.

30

Actual results in future periods for CMS Energy and Consumers could differ materially from historical results and the forward-looking statements contained in this report. Factors that might cause or contribute to these differences include, but are not limited to, those discussed in the following sections. CMS Energy's and Consumers' businesses are influenced by many factors that are difficult to predict, that involve uncertainties that may materially affect results, and that are often beyond their control. Additional risks and uncertainties not presently known or that the companies' management believes to be immaterial may also adversely affect the companies. The risk factors described in the following sections, as well as the other information included in this report and in other documents filed with the SEC, should be considered carefully before making an investment in securities of CMS Energy or Consumers. Risk factors of Consumers are also risk factors of CMS Energy. All of these risk factors are potentially significant.

CMS Energy depends on dividends from its subsidiaries to meet its debt service obligations.

Due to its holding company structure, CMS Energy depends on dividends from its subsidiaries to meet its debt service and other payment obligations. Consumers' ability to pay dividends or acquire its own stock from CMS Energy is limited by restrictions contained in Consumers' preferred stock provisions and potentially by other legal restrictions, such as certain terms in its articles of incorporation, and by FERC requirements. At December 31, 2012, under its articles of incorporation, Consumers had $536 million of unrestricted retained earnings available to pay common stock dividends. If sufficient dividends are not paid to CMS Energy by its subsidiaries, CMS Energy may not be able to generate the funds necessary to fulfill its payment obligations, which could have a material adverse effect on CMS Energy's liquidity and financial condition.

CMS Energy has indebtedness that could limit its financial flexibility and its ability to meet its debt service obligations.

At December 31, 2012, CMS Energy, including Consumers, had $7.2 billion aggregate principal amount of indebtedness. CMS Energy had $2.4 billion aggregate principal amount of indebtedness at December 31, 2012. At December 31, 2012, there were no borrowings and $2 million of letters of credit outstanding under CMS Energy's revolving credit agreement. CMS Energy and its subsidiaries may incur additional indebtedness in the future.

The level of CMS Energy's present and future indebtedness could have several important effects on its future operations, including, among others:

- •

- a significant portion of CMS Energy's cash flow from operations could be dedicated to the payment of principal and interest on its indebtedness and would not be available for other purposes;

- •

- covenants contained in CMS Energy's existing debt arrangements, which require it to meet certain financial tests, could affect its flexibility in planning for, and reacting to, changes in its business;

- •

- CMS Energy's ability to obtain additional financing for working capital, capital expenditures, acquisitions, and general corporate and other purposes could become limited;

- •

- CMS Energy could be placed at a competitive disadvantage to its competitors that are less leveraged;

31

- •

- CMS Energy's vulnerability to adverse economic and industry conditions could increase; and

- •

- CMS Energy's future credit ratings could fluctuate.

CMS Energy's ability to meet its debt service obligations and to reduce its total indebtedness will depend on its future performance, which will be subject to general economic conditions, industry cycles, changes in laws or regulatory decisions, and financial, business, and other factors affecting its operations, many of which are beyond its control. CMS Energy cannot make assurances that its business will continue to generate sufficient cash flow from operations to service its indebtedness. If CMS Energy is unable to generate sufficient cash flows from operations, it may be required to sell assets or obtain additional financing. CMS Energy cannot ensure that additional financing will be available on commercially acceptable terms or at all.

CMS Energy and Consumers have financing needs and could be unable to obtain bank financing or access the capital markets. Potential disruption in the capital and credit markets could have a material adverse effect on CMS Energy's and Consumers' businesses, including the availability and cost of short-term funds for liquidity requirements and their ability to meet long-term commitments. These consequences could have a material adverse effect on CMS Energy's and Consumers' liquidity, financial condition, and results of operations.

CMS Energy and Consumers may be subject to liquidity demands under commercial commitments, guarantees, indemnities, letters of credit, and other contingent liabilities. Consumers' capital requirements are expected to be substantial over the next several years as it implements renewable power generation and environmental projects, and those requirements may increase if additional laws or regulations are adopted or implemented.

CMS Energy and Consumers rely on the capital markets, particularly for publicly offered debt, as well as on bank syndications, to meet their financial commitments and short-term liquidity needs if internal funds are not available from Consumers' operations and, in the case of CMS Energy, dividends from Consumers and its other subsidiaries. CMS Energy and Consumers also use letters of credit issued under certain of their revolving credit facilities to support certain operations and investments.

Longer term disruptions in the capital and credit markets as a result of uncertainty, changing or increased regulation, reduced alternatives, or failures of significant financial institutions could adversely affect CMS Energy's and Consumers' access to liquidity needed for their respective businesses, as could Consumers' inability to obtain prior FERC authorization for any securities issuances, including publicly offered debt, as is required under the Federal Power Act. Any disruption or inability to obtain FERC authorization could require CMS Energy and Consumers to take measures to conserve cash until the markets stabilize or until alternative credit arrangements or other funding for their business needs can be arranged. These measures could include deferring capital expenditures, changing CMS Energy's and Consumers' commodity purchasing strategy to avoid collateral-posting requirements, and reducing or eliminating future share repurchases, dividend payments, or other discretionary uses of cash.

CMS Energy continues to explore financing opportunities to supplement its financial plan. These potential opportunities include refinancing and/or issuing new debt, preferred stock and/or common equity, and bank financing. Similarly, Consumers plans to seek funds through the capital markets, commercial lenders, and leasing arrangements. Entering into new financings is subject in part to capital market receptivity to utility industry securities in general and to CMS Energy's and Consumers' securities in particular. CMS Energy and Consumers cannot

32

guarantee the capital markets' acceptance of their securities or predict the impact of factors beyond their control, such as actions of rating agencies. If CMS Energy or Consumers is unable to obtain bank financing or access the capital markets to incur or refinance indebtedness, or is unable to obtain commercially reasonable terms for any financing, there could be a material adverse effect on its liquidity, financial condition, and results of operations.

Certain of CMS Energy's securities and those of its affiliates, including Consumers, are rated by various credit rating agencies. Any reduction or withdrawal of one or more of its credit ratings could have a material adverse impact on CMS Energy's or Consumers' ability to access capital on acceptable terms and maintain commodity lines of credit, could make its cost of borrowing higher, and could cause CMS Energy or Consumers to reduce its capital expenditures. If it is unable to maintain commodity lines of credit, CMS Energy or Consumers may have to post collateral or make prepayments to certain of its suppliers under existing contracts. Further, since Consumers provides dividends to CMS Energy, any adverse developments affecting Consumers that result in a lowering of its credit ratings could have an adverse effect on CMS Energy's credit ratings. CMS Energy and Consumers cannot guarantee that any of their present ratings will remain in effect for any given period of time or that a rating will not be lowered or withdrawn entirely by a rating agency.

There are risks associated with Consumers' significant capital investment program planned for the next five years.