UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

Amendment No. 1

(Mark One)

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2018

OR

TRANSITION REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

TRANSITION REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Commission file number: 001-36635

CNX MIDSTREAM PARTNERS LP

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

47-1054194 (I.R.S. Employer Identification No.) |

CNX Center, 1000 CONSOL Energy Drive

Canonsburg, PA 15317-6506

(724) 485-4000

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of exchange on which registered | |||

| Common Units Representing Limited Partner Interests | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes  No

No

Indicate by check mark if the registrant is not

required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes  No

No

Indicate by check mark whether

the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during

the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject

to such filing requirements for the past 90 days. Yes  No

No

Indicate by check mark whether

the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation

S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required

to submit such files). Yes  No

No

Indicate by check mark if

disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein,

and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated

by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer  |

Accelerated filer  |

Non-accelerated filer  |

Smaller reporting company  |

Emerging growth company  |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period

for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Act). Yes  No

No

The aggregate market value of common units held by non-affiliates of the registrant as of June 29, 2018, the last business day of the registrant’s most recently completed second fiscal quarter, was $813.3 million. This is based on the closing price of common units on the New York Stock Exchange on such date.

As of March 12, 2019, CNX Midstream Partners LP had 63,730,710 common units outstanding.

EXPLANATORY NOTE

CNX Midstream Partners LP (the “Partnership”) is filing this Amendment No. 1 on Form 10-K/A (this “Amendment”) to its Annual Report for the fiscal year ended December 31, 2018, originally filed with the Securities and Exchange Commission (the “SEC”) on February 7, 2019 (the “Original Form 10-K”), solely to include information required by Items 11 and 12 of Part III of Form 10-K and to update Item 10 of Part III of Form 10-K to reflect current information regarding the directors and executive officers of the Partnership’s general partner. The information required by Items 11 and 12 of Part III of Form 10-K was previously omitted from the Original Form 10-K in reliance on General Instruction G(3) to Form 10-K. This Amendment amends and restates in its entirety Items 10, 11 and 12 of Part III of the Original Form 10-K.

In addition, pursuant to Rule 12b-15 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), Part IV, Item 15 has also been amended and restated to include the currently dated certifications from the Partnership’s principal executive officer and principal financial officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. Because no financial statements have been amended by or included in this Amendment and this Amendment does not contain or amend any disclosure with respect to Items 307 and 308 of Regulation S-K, paragraphs 3, 4, and 5 of the certifications have been omitted. We are not including certifications pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, as no financial statements are being filed with this Amendment.

Except as described above, this Amendment does not otherwise revise, restate, modify or update any information in the Original Form 10-K. Accordingly, this Amendment should be read in conjunction with the Original Form 10-K and the Partnership’s other filings with the SEC.

| i |

| ITEM 15. | Exhibits and Financial Statement Schedules | 41 |

| SIGNATURES | 44 |

| ii |

| ITEM 10. | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE |

Management of CNX Midstream Partners LP

We are managed by the directors and executive officers of our general partner, CNX Midstream GP LLC. Our general partner is not elected by our unitholders and will not be subject to re-election by our unitholders in the future. CNX Gathering LLC (“CNX Gathering”), in which CNX Resources Corporation (the “Company”) owns a 100% membership interest, owns all of the membership interests in our general partner and has the right to appoint the entire Board of Directors of our general partner (the “Board of Directors”), including our independent directors. Our unitholders are not entitled to elect the Board of Directors or to directly or indirectly participate in our management or operations. Our general partner will be liable, as general partner, for all of our debts (to the extent not paid from our assets), except for indebtedness or other obligations that are made specifically nonrecourse to it. Whenever possible, we intend to incur indebtedness that is nonrecourse to our general partner.

In evaluating director candidates, CNX Gathering assesses whether a candidate possesses the integrity, judgment, knowledge, experience, skill and expertise that are likely to enhance the ability of our Board of Directors to manage and direct our affairs and business, including, when applicable, to enhance the ability of committees of the Board of Directors of our general partner to fulfill their duties.

Neither we nor our subsidiaries have any employees. Our general partner has the sole responsibility for providing the employees and other personnel necessary to conduct our operations. All of the employees that conduct our business are employed by our general partner or its affiliates, but we sometimes refer to these individuals in this Amendment as our employees.

Director Independence

As a publicly traded partnership, we qualify for, and are relying on, certain exemptions from the New York Stock Exchange’s (“NYSE”) corporate governance requirements, including the requirements that the Board of Directors:

| • | consist of a majority of independent directors; |

| • | have a nominating/corporate governance committee that is composed entirely of independent directors; and |

| • | have a compensation committee that is composed entirely of independent directors. |

As a result of these exemptions, the Board of Directors is not comprised of a majority of independent directors. The Board of Directors does not currently intend to establish a nominating/corporate governance committee or a compensation committee. Accordingly, unitholders will not have the same protections afforded to equity holders of companies that are subject to all of the corporate governance requirements of the NYSE.

We are, however, required to have an audit committee of at least three members, and all of its members are required to meet the independence and experience standards established by the NYSE and the Exchange Act.

| 1 |

Committees of the Board of Directors

The Board of Directors has an audit committee, and may have such other committees as the Board of Directors shall determine from time to time. The Board of Directors may establish a conflicts committee to review specific matters that the Board of Directors believes may involve a conflict of interest as further described below.

Audit Committee

The audit committee of the Board of Directors (the “Audit Committee”) assists with oversight of the integrity of our financial statements and our compliance with legal and regulatory requirements and partnership policies and controls. The Audit Committee has the sole authority to (1) retain and terminate our independent registered public accounting firm, (2) approve all auditing services and related fees and the terms thereof performed by our independent registered public accounting firm and (3) pre-approve any non-audit services and tax services to be rendered by our independent registered public accounting firm. The Audit Committee is also responsible for confirming the independence and objectivity of our independent registered public accounting firm. Our independent registered public accounting firm is given unrestricted access to the Audit Committee and our management, as necessary. Ms. Angela A. Minas (Chairperson) and Messrs. Raymond T. Betler and John E. Jackson comprise the members of the Audit Committee, all of whom are independent under the standards of the NYSE and the Exchange Act. Each of Ms. Minas and Messrs. Betler and Jackson satisfy the definition of “audit committee financial expert” for purposes of the SEC’s rules.

The Audit Committee oversees the Partnership’s financial reporting process on behalf of the Board of Directors. Management has the primary responsibility for the financial statements and the reporting process, including the systems of internal controls.

In fulfilling its oversight responsibilities, the Audit Committee reviewed and discussed with management the audited financial statements contained in the Original Form 10-K.

The Partnership’s independent registered public accounting firm, Ernst & Young LLP (“EY”), is responsible for expressing an opinion on the conformity of the audited financial statements with accounting principles generally accepted in the United States of America. The Audit Committee reviewed with EY the firm’s judgment as to the quality, not just the acceptability, of the Partnership’s accounting principles and such other matters as are required to be discussed with the Audit Committee under generally accepted auditing standards. The Audit Committee also discussed with EY the matters required to be discussed under the rules adopted by the Public Company Accounting Oversight Board.

Based on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Original Form 10-K for filing with the SEC.

Conflicts Committee

The Board of Directors has the ability to establish a conflicts committee under our partnership agreement. If established, at least two members of the Board of Directors will serve on the conflicts committee to review specific matters that may involve conflicts of interest in accordance with the terms of our partnership agreement. The Board of Directors will determine whether to refer a matter to the conflicts committee on a case-by-case basis. The members of our conflicts committee may not be officers or employees of our general partner or directors, officers or employees of its affiliates (including the Company), and must meet the independence and experience standards established by the NYSE and the Exchange Act to serve on an audit committee of a board of directors. In addition, the members of our conflicts committee may not own any interest in our general partner or any interest in us or our subsidiaries other than common units or awards under our long-term incentive plan. If our general partner seeks approval from the conflicts committee, then it will be presumed that, in making its decision, the conflicts committee acted in good faith, and in any proceeding brought by or on behalf of any limited partner or the Partnership challenging such determination, the person bringing or prosecuting such proceeding will have the burden of overcoming such presumption.

| 2 |

Board Leadership Structure and Role in Risk Oversight

Mr. Nicholas J. DeIuliis currently serves as the Chairman of the Board of Directors. Directors of the Board of Directors are designated or appointed by CNX Gathering. Accordingly, unlike holders of common stock in a corporation, our unitholders have only limited voting rights on matters affecting our business or governance, subject in all cases to any specific unitholder rights contained in our partnership agreement.

Our corporate governance guidelines provide that the Board of Directors is responsible for reviewing the process for assessing the major risks facing us and the options for their mitigation. This responsibility is largely satisfied by our Audit Committee, which is responsible for reviewing and discussing with management and our independent registered public accounting firm our major risk exposures and the policies management has implemented to monitor such exposures, including our financial risk exposures and risk management policies.

Non-Management Executive Sessions and Unitholder Communications

The non-management members of the Board of Directors regularly meet in executive session in connection with each regularly scheduled meeting of the Board of Directors, and Ms. Minas, as Chair of the Audit Committee, presided over all such executive sessions in 2018.

Unitholders and interested parties can communicate directly with non-management directors by mail in care of the Corporate Secretary at CNX Midstream Partners LP, CNX Center, 1000 CONSOL Energy Drive, Canonsburg, Pennsylvania 15317. Such communications should specify the intended recipient or recipients. Commercial solicitations or communications will not be forwarded.

Meetings and Other Information

During the last fiscal year, our Board of Directors had 11 meetings, of which four were “regularly scheduled meetings” and seven were “special meetings.” Our Audit Committee had seven meetings, of which four were “regularly scheduled meetings” and three were “special meetings.” All directors have access to members of management, and a substantial amount of information transfer and informal communication occurs between meetings.

Our Code of Business Conduct and Ethics, Corporate Governance Guidelines, Whistleblower Policy and Audit Committee Charter are available on our website (www.cnxmidstream.com) under the “Our Governance” tab. Our Code of Business Conduct and Ethics applies to our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. We intend to disclose any amendment to, or waiver of, our Code of Business Conduct and Ethics on our website (www.cnxmidstream.com).

Directors and Executive Officers of CNX Midstream GP LLC

Directors are appointed by CNX Gathering, the sole member of our general partner, and hold office until their successors have been appointed or qualified or until their earlier death, resignation, removal or disqualification. Executive officers are appointed by, and serve at the discretion of, the Board of Directors. The following table presents information for the directors and executive officers of CNX Midstream GP LLC as of April 18, 2019.

| Name | Age | Position with Our General Partner |

| Nicholas J. DeIuliis | 50 | Chairman and Chief Executive Officer |

| Donald W. Rush | 36 | Director and Chief Financial Officer |

| Timothy C. Dugan | 57 | Chief Operating Officer |

| Chad A. Griffith | 41 | Director and President |

| Brian R. Rich | 42 | Chief Accounting Officer |

| Angela A. Minas | 55 | Director and Audit Committee Chair |

| Raymond T. Betler | 63 | Director and Audit Committee Member |

| John E. Jackson | 60 | Director and Audit Committee Member |

| Hayley F. Scott | 47 | Director |

| 3 |

Nicholas J. DeIuliis has served as Chairman of the Board and Chief Executive Officer of the general partner since January 3, 2018. Mr. DeIuliis is a Director and the President and Chief Executive Officer of the Company. Mr. DeIuliis has more than 25 years of experience with the Company and in that time has held the positions of Chief Executive Officer since May 7, 2015, President since February 23, 2011, and previously served as the Chief Operating Officer, Senior Vice President–Strategic Planning, and earlier in his career various engineering positions. He was a Director, President and Chief Executive Officer of CNX Gas LLC (“CNX Gas”) from its creation in 2005 through 2009. Mr. DeIuliis was a Director and Chairman of the Board of the general partner of CONSOL Coal Resources LP (formerly known as CNX Coal Resources LP) from March 16, 2015 until November 28, 2017. Mr. DeIuliis is a member of the Board of Directors of the University of Pittsburgh Cancer Institute and the Center for Responsible Shale Development. Mr. DeIuliis is a registered engineer in the Commonwealth of Pennsylvania and a member of the Pennsylvania bar. As the Chief Executive Officer of the Company and our general partner, Mr. DeIuliis brings a unique perspective on the business to the Board of Directors with over 25 years with the Company, and a deep understanding of the operations and culture and the Company and its affiliates.

Donald W. Rush has served as a Director and Chief Financial Officer of the general partner since January 3, 2018. Mr. Rush has also served as the Executive Vice President and Chief Financial Officer of the Company since July 11, 2017. He previously served as Vice President of Energy Marketing where he oversaw the Company’s commercial functions, including mergers and acquisitions, gas marketing and transportation, in addition to holding other strategy and planning, business development and engineering positions during his 12 years with the Company. He successfully guided the Company through every significant transaction during its transition into a pure play natural gas exploration and production company, including the sale of the Company’s five West Virginia coal mines in 2013 and the separation of the Company’s Marcellus Shale joint venture with Noble Energy Inc. in 2016. Mr. Rush holds a B.S. in civil engineering from the University of Pittsburgh and an M.B.A. from Carnegie Mellon University’s Tepper School of Business. As the Chief Financial Officer of the Company and our general partner, he brings significant commercial and financial expertise to the Board of Directors, and a deep understanding of the operations and culture of the Company and its affiliates.

Timothy C. Dugan has served as Chief Operating Officer of our general partner since January 12, 2018. He previously served as a Director of the general partner from January 3, 2018 to February 8, 2019. Mr. Dugan has also served as an Executive Vice President of the Company since September 20, 2016 and Chief Operating Officer of the Company since January 28, 2014. Before being appointed to his current position, he was President and Chief Operating Officer of CNX Gas Corporation from May 2014 to December 2014 when he became President and Chief Executive Officer. Prior to joining the Company, Mr. Dugan was Vice President–Appalachia South Business Unit at Chesapeake Energy Corporation. During his seven years with Chesapeake Energy Corporation, he held several titles, including Senior Asset Manager and District Manager. Mr. Dugan began his petroleum and natural gas engineering career in 1984 with Cabot Oil & Gas Corporation as a General Foreman and Field Consultant, and he held other industry related positions with progressing responsibility at various oil and gas companies. Mr. Dugan is a member of the Society of Petroleum Engineers.

| 4 |

Chad A. Griffith has served as a Director and as President of our general partner since February 8, 2019 and September 24, 2018, respectively. Mr. Griffith also currently serves as the Vice President, Commercial and Vice President of Marketing of the Company. Prior to his current position, Mr. Griffith served as the Director of Marketing of the Company from November 2015 to January 2018. He was the Director of Diversified Business Units at the Company from April 2014 to November 2015. Prior to that role, Mr. Griffith held several positions with the Title group at the Company, including the Director of Title and Land Services from November 2012 to April 2014, Manager, Title and Contracting from March 2012 to November 2012, and Manager - Title from February 2011 to March 2012. Mr. Griffith holds a bachelor’s degree from Frostburg State University, a law degree from West Virginia University College of Law, and an M.B.A. from Carnegie Mellon University’s Tepper School of Business. Mr. Griffith is a licensed attorney in Maryland and is licensed but inactive in West Virginia. As the President of our general partner and a senior executive with the Company, he brings significant legal, marketing and commercial experience to the Board of Directors, and a deep understanding of the operations and culture of the Company and its affiliates.

Brian R. Rich has served as Chief Accounting Officer of our general partner since November 4, 2015. Prior to his appointment as Chief Accounting Officer of our general partner, Mr. Rich was a senior manager within the Company’s accounting department since November 2014, serving in positions of increasing responsibility. Prior to joining the Company, Mr. Rich held various accounting positions at Education Management Corporation from March 2007 through November 2014, including Vice President and Assistant Controller, a position he held upon his departure. Prior to his time at Education Management Corporation, Mr. Rich served in various positions (from associate through manager) with PricewaterhouseCoopers LLP from October 1999 through March 2007, primarily serving the energy sector. Mr. Rich is a Certified Public Accountant licensed in Pennsylvania.

Angela A. Minas was appointed a Director of our general partner and Chairperson of our Audit Committee effective September 25, 2014. Ms. Minas also currently serves on the board of directors of Weatherford International plc and on the board of directors of the general partner of Westlake Chemical Partners LP, a public master limited partnership. Ms. Minas previously served on the board of directors and as Audit Committee Chair for Ciner Resources LP, a public master limited partnership. Ms. Minas previously served as Vice President and Chief Financial Officer of Nemaha Oil and Gas, LLC, a private exploration and production portfolio company backed by Pine Brook Road Partners, a private equity firm from March 2012 to August 2014. From 2008 to 2012, Ms. Minas served as Vice President and Chief Financial Officer of the general partner of DCP Midstream Partners, LP, a public master limited partnership. From 2006 to 2008, Ms. Minas served as Chief Financial Officer, Chief Accounting Officer and Treasurer of Constellation Energy Partners LLC, a public master limited liability company. Prior to her corporate roles in the MLP industry, Ms. Minas spent 20 years in the management consulting industry and held numerous leadership roles, including Partner responsible for Arthur Andersen’s North American oil and gas consulting practice. Ms. Minas serves on the Council of Overseers of the Rice University Graduate Business School. Ms. Minas’ previous experience with public master limited partnerships and the natural resource industry, as well as her knowledge of financial statements, provide her with the necessary skills to be a member of the Board of Directors.

| 5 |

Raymond T. Betler was appointed as a Director of our general partner and member of our Audit Committee effective October 18, 2017. Mr. Betler is a Director and the President and Chief Executive Officer of Westinghouse Air Brake Technologies Corporation (NYSE: WAB) (“Wabtec”), a leading supplier of value-added, technology based products and services for freight rail, passenger transit and select industrial markets worldwide. Prior to becoming CEO in 2014, Mr. Betler served Wabtec as President and Chief Operating Officer from May 2013 until May 2014, and Chief Operating Officer from December 2010 until May 2013. Mr. Betler was Vice President and Group Executive of the Transit Group of Wabtec from August 2008 until December 2010. Prior to his tenure with Wabtec, Mr. Betler served as President, Total Transit Systems for Bombardier Transportation. He held various executive roles within Bombardier during his 30-year career with the transportation company and its numerous predecessors. Mr. Betler is also a Director at Dollar Bank. We believe that Mr. Betler’s public company background and experience in financial matters, along with the leadership attributes indicated by his executive experience, provide an important source of insight and perspective to the Board of Directors.

John E. Jackson was appointed as a Director of our general partner and member of our Audit Committee effective January 20, 2015. Mr. Jackson is the President and Chief Executive Officer of Spartan Energy Partners, LP (“Spartan”), a privately owned gas gathering, treating & processing company. He has been with Spartan since its formation in March 2010. Mr. Jackson was Chairman, CEO and President of Price Gregory Services, Inc., a pipeline-related infrastructure service provider from February 2008 until its sale in October of 2009. He served as a director of Hanover Compressor Company (“Hanover”), now known as Exterran Holdings, Inc. (NYSE: EXH), from July 2004 until May 2010. Mr. Jackson served as Hanover’s President and CEO from October 2004 to August 2007 and as Chief Financial Officer from January 2002 to October 2004. Mr. Jackson is a director of Seitel, Inc., a privately owned provider of seismic data to the oil & gas industry in North America, since August 2007, Select Energy Services, LLC, a privately owned total water management company for oil and gas companies, since January 2012 & Main Street Capital Corporation (NYSE: MAIN) a publicly traded BDC, since August 2013. Previously, Mr. Jackson served as a director of Encore Energy Partners (NYSE: ENP) from January 2009 until its sale in December 2011 and RSH Energy, LLC, a privately owned engineering firm, from September 2013 to March 2014. He also serves on the boards of several non-profit organizations. We believe that Mr. Jackson’s background in the energy industry and experience in financial matters, along with the leadership attributes indicated by his executive experience, provide an important source of insight and perspective to the Board of Directors.

Hayley F. Scott was appointed as a Director of our general partner effective February 8, 2019. She has also served as the Company’s Vice President, Financial Planning and Analysis since June 2017. Ms. Scott held the same position at CONSOL Energy Inc. prior to the separation of CONSOL Energy Inc. from the Company in November 2017 (the “Separation”). Before joining the Company, Ms. Scott was the General Manager of Strategy and Business Development at United States Steel Corporation (“U. S. Steel”). During her sixteen years at U. S. Steel, from 2001 to 2017 she held several titles, including Chief Financial Officer of Business Intelligence & Support Services and Director of Joint Ventures and Strategic Planning. Previously, Ms. Scott was a manager for the Assurance and Business Advisory Services practice of PricewaterhouseCoopers. Ms. Scott has also served on the boards of several private companies and a non-profit organization. She holds a Bachelor of Science degree in accounting from Penn State University and is a Certified Public Accountant. Ms. Scott brings extensive knowledge of financial planning and strategic development to the Board of Directors, along with her knowledge of the culture of the Company and its affiliates.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires directors, executive officers and persons who beneficially own more than ten percent of a registered class of our equity securities (collectively, “Insiders”) to file with the SEC initial reports of ownership and reports of changes in ownership of such equity securities. Insiders are also required to furnish us with copies of all Section 16(a) forms that they file. Such reports are accessible on or through our website at www.cnxmidstream.com.

Based solely upon a review of the copies of Forms 3 and 4 furnished to us, or written representations from certain reporting persons that no Forms 5 were required, we believe that the Insiders complied with all filing requirements with respect to transactions in our equity securities during 2018, except that one Form 4 reporting one transaction for each of Ms. Minas and Mr. Jackson related to the vesting of phantom unit awards was filed late on May 17, 2018.

| 6 |

| ITEM 11. | EXECUTIVE COMPENSATION |

Compensation Discussion and Analysis

Introduction

Neither we nor our general partner employ any of the individuals who serve as executive officers of our general partner and who are responsible for managing our business. We are managed by our general partner. For 2018, the executive officers of our general partner were employees of the Company, and their respective compensation was set and paid by the Company under its compensation programs. We and our general partner are parties to an operational services agreement with the Company pursuant to which, among other matters:

| • | the Company made available to our general partner the services of its employees who acted as the executive officers of our general partner; and |

| • | our general partner paid administrative fees to the Company to cover the services provided to us by the executive officers of our general partner who were employees of the Company. For 2018, such fees totaled approximately $1.0 million. |

During 2018, our named executive officers (“named executives”)* were:

| • | Nicholas J. DeIuliis, Chief Executive Officer (“CEO” or “Chief Executive Officer”) |

| • | Donald W. Rush, Chief Financial Officer |

| • | Chad A. Griffith, President |

| • | Timothy C. Dugan, Chief Operating Officer |

*Following the Separation, the Board of Directors reviewed the executive management team and their respective roles and responsibilities. Given the reduced size of the overall Company (including the general partner), the Board of Directors determined that the “executive officers,” as defined by the applicable SEC rule, were Messrs. DeIuliis, Rush, and Dugan, and with respect to the general partner and in connection with his September 2018 appointment as President, Mr. Griffith, and that no other Company employees held positions, roles and responsibilities within the Partnership that qualified him or her as an “executive officer” of the Partnership within the meaning of such rule during fiscal 2018.

In addition to the four individuals noted above, John T. Lewis and David M. Khani served as Chief Executive Officer and Chief Financial Officer, respectively, for the three-day period from January 1 through January 3, 2018. However, neither individual received any compensation for such three-day period, and as such, will not be included in any of the tabular or narrative disclosure for 2018 with respect to executive compensation. There were no other executive officers of the general partner serving at the end of 2018.

This Compensation Discussion and Analysis (“CD&A”) provides an overview of compensation policies and programs applicable to our named executives and describes the compensation objectives, policies and practices with respect to our named executives. The elements of compensation provided by the Company with respect to our named executives’ compensation are not subject to approval by the Board of Directors other than with respect to awards made under the CNX Midstream Partners LP 2014 Long-Term Incentive Plan (the “CNXM LTIP”). The Board of Directors approved the grant of phantom unit awards to Messrs. Rush and Griffith in January 2019 to provide them compensation that directly incentivizes performance at the Partnership and align their interests with the Partnership's unitholders.

Members of the Board of Directors who are employees of the Company (Messrs. DeIuliis, Rush and after their appointment on February 1, 2019, Mr. Griffith and Ms. Scott) do not receive any additional compensation in connection with their board service specifically. The following discussion provides information about the Company’s compensation decisions and policies with regard to our named executives for the 2018 fiscal year, and is intended to provide investors with the information necessary to understand the Company’s compensation policies and decisions. It also provides context for the disclosure included in the executive compensation tables below.

This CD&A contains references to one or more financial measures that have not been calculated in accordance with generally accepted accounting principles (“GAAP”). A reconciliation of each disclosed non-GAAP financial measure to the most directly comparable GAAP financial measure is provided in the “Calculation of Non-GAAP Financial Measures” section of this CD&A.

Summary

The Company’s executive compensation program is designed to attract, motivate, and retain key executives who will promote both the short- and long-term growth of the Company and its affiliates, and create sustained shareholder value. To this end, the Company takes a pay-for-performance approach to its executive compensation program that ties the majority of the compensation payable to executives to stock price and operational performance, and promotes equity ownership among the executives to greater align their interests with those of the Company’s shareholders.

| 7 |

Compensation Setting Process

Compensation Philosophy and Objectives

The Company’s compensation philosophy is to provide a total compensation package—that is, base salary, short-term (annual) incentive compensation, long-term (equity-based) compensation (generally, in the form of restricted share units (“RSUs”) and performance share units (“PSUs”)), retirement compensation (401(k) contributions), and benefits (such as health insurance, vacation, etc.) that will attract and retain employees with the education, experience, values, initiative and drive necessary to execute the Company’s business plan and achieve the Company’s long-term strategic goals. Each executive’s total compensation opportunity is generally targeted within a reasonable range around the median of similarly-situated executives at the Company’s peer group companies after consideration of the items described in the next paragraph. See “Use of Peer Group Data” below for a list of the companies included in the Company’s 2018 peer group. As further described below, Mr. Griffith was not an executive officer of the Company in 2018 and, as a result, the process and considerations applicable to his 2018 compensation were different than for our other named executives.

The Compensation Committee of the Company’s Board of Directors (the “Compensation Committee”) reviewed and determined the compensation of Messrs. DeIuliis, Rush and Dugan, who were executive officers of the Company at the beginning of fiscal 2018 (Mr. Griffith did not become an executive officer of the Company until February 2019). Key factors affecting the Compensation Committee’s executive compensation determinations included: (i) the nature and scope of an executive’s responsibilities; (ii) an executive’s performance (including contribution to the Company’s financial results); and (iii) the Compensation Committee’s outside compensation consultant’s report(s) on survey and/or proxy data for compensation paid to executives with similar responsibilities at other similarly-situated companies. In the case of Mr. Griffith, his 2018 compensation was established by Mr. Dugan, his supervisor at that time, with assistance from the Company’s Human Resources personnel and consistent with merit guidelines applicable at a Company-wide level to non-executive employees.

Use of Peer Group Data

A primary factor that the Compensation Committee considered in determining the total compensation opportunity available to each of Messrs. DeIuliis, Rush and Dugan was whether such total compensation opportunity was competitive with the total compensation opportunities offered to similarly-situated executives by the Company’s competitors.

In connection with the Company becoming a pure-play

oil and gas exploration and production (“E&P”) company, the Compensation Committee modified the Company’s

peer group for 2018 to select peers that are engaged in businesses substantially similar to the Company’s business. The following

peer companies were used to help establish 2018 compensation for Messrs. DeIuliis, Rush and Dugan (collectively, the “peer

group”):

| Antero Resources Corporation | EQT Corporation | Southwestern Energy Corporation |

| Cabot Oil and Gas Corporation | Gulfport Energy Corporation | SM Energy Company |

| Chesapeake Energy Corporation | PDC Energy Inc. | Whiting Petroleum Corporation |

| Energen Corp. | Range Resources Corporation | WPX Energy |

Role of Compensation Consultant

The compensation consultant is retained by the Compensation Committee and works with the Compensation Committee in coordination with the Company’s management. For 2018, the Compensation Committee engaged Mercer (the “consultant”) to assist with the development of the Company’s 2018 executive compensation program. A consultant representative generally attended Compensation Committee meetings and was available to participate in executive sessions.

The Compensation Committee looked to the compensation consultant to review the elements of the Company’s compensation program, including the appropriate mix of short- and long-term incentives, and for any recommendations of modifications thereto, based on their review of the market practices at a peer group of companies and the Company’s compensation objectives. The consultant also provided input on the design of the Company’s incentive programs and the underlying performance metrics.

| 8 |

Process for Evaluating Compensation

Generally, in the first quarter of each year, the Compensation Committee meets to establish the executives’ base salaries, incentive opportunities, and related performance goals of the Company’s incentive compensation programs, including the short-term incentive compensation program (“STIC”) and long-term incentive compensation program (“LTIC”). This general process was used to establish compensation for Messrs. Rush and Dugan for 2018. To establish compensation for a particular person, the Company’s Human Resources personnel make initial assessments that are submitted to Mr. DeIuliis for review. These assessments consider relevant industry salary practices, the complexity and level of responsibility associated with the particular person’s position, the position’s overall importance to the Company in relation to other executive positions, and the competitiveness of the person’s total compensation. Mr. DeIuliis may make appropriate changes to this qualitative assessment based on his determination of such person’s past performance. The Compensation Committee then reviews: (i) Mr. DeIuliis’ compensation recommendations for each person; (ii) Mr. DeIuliis’ evaluation of each of Messrs. Rush and Dugan’s performance and internal value; and (iii) the benchmarking studies as compiled by the consultant.

After considering the factors described above, and in consultation with Mr. DeIuliis and the consultant, the Compensation Committee approved the 2018 compensation packages for Messrs. Rush and Dugan.

To establish compensation for Mr. DeIuliis, the Compensation Committee reviews: (i) the benchmarking studies and compensation alternatives compiled by the consultant; (ii) his self-evaluation of his annual performance; and (iii) the Company’s Board of Directors’ evaluation of his annual performance.

After considering these factors, the Compensation Committee reviews and approves, and recommends that the Company’s Board of Directors approves, Mr. DeIuliis’ compensation. Mr. DeIuliis does not participate in, and is not present for, any approvals relating to his compensation.

| 9 |

Compensation Decisions for 2018

Elements of Executive Compensation Program

In 2018, the Company continued to compensate its executives through the following:

Compensation Element Form of Compensation Performance Criteria/Formula Purpose

Base Salary •Cash Individual performance and experience in the role are primary factors in determining base salaries. To provide fixed compensation to attract and retain key executives and offset the cyclicality in the Company’s business that impacts variable pay

Short Term Incentive Compensation Program (“STIC”)

•Cash For the Company’s 2018 STIC, the formula was:

Performance Measure Individual Performance Total Result Adjusted EBITDA/ Share + Capped at 20% of Total STIC Payout = 200%* + Indiv. Perform.

To provide incentives to employees to achieve Adjusted EBITDA and operational performance goals for the year and to reward employees for the achievement of those goals.

* 150% for Mr. Griffith.

Long-Term Incentive Compensation Program (“LTIC”)

•2016, 2017 and 2018 PSUs (vesting 1/5 per year for five years)

•PSUs represented 55% of the LTIC in 2018, 2017 and 2016 •For the PSU awards granted in 2018 for the 2018 – 2022 performance period, the LTIC formula was as follows:

Performance measure (2018 PSUs) Weight Total Units Earned (2018 Tranche)

Relative TSR (S&P 500) 50% 33% Absolute Stock Price 50%

•For the PSU awards granted in 2017 for the 2017 – 2021 performance period, the LTIC formula was as follows:

Performance measure (2017 PSUs) Weight Total Units Earned (2018 Tranche)

Relative TSR (S&P 500) 50% 0% Absolute Stock Price 50%

•For the PSU awards granted in 2016 for the 2016 – 2020 performance period, the LTIC formula was as follows:

Performance measure (2016 PSUs) Weight Total Units Earned (2018 Tranche)

Relative TSR (S&P 500) 50% 200% Absolute Stock Price 50%

•2018 RSUs (vesting 1/3 per year for three years)

•RSUs represented 45% of the 2018 LTIC •RSUs have time-based vesting

To create a strong incentive for key management members to achieve long-term performance objectives and strategic plan and to align management’s interests with those of the Company’s shareholders. Equity awards also are intended to retain executive talent. All equity awards settle in stock.

Other Agreements and Benefits •Retirement Benefits •Change in Control Agreements To attract and retain key management members and, for change in control agreements, to motivate executives to take actions that are in the best interests of the Company.

Perquisites Examples of our perquisites include: •Social Club Memberships •Vehicle Allowance •Occasional Event Tickets To provide a competitive compensation package.

| 10 |

2018 Base Salary

The Compensation Committee reviewed the base salaries of Messrs. DeIuliis, Rush and Dugan as compared to those of the peer group companies, and as a result, recommended increases to their base salaries for 2018. Mr. DeIuliis declined an increase to his base salary. The annual base salaries of our named executives were as follows for 2018 and 2017:

| Named Executive | Salaries at Year-End 2017 | Salaries at Year-End 2018 | Percent Change | |||||||

| Chief Executive Officer | $ | 800,000 | $ | 800,000 | 0% | |||||

| Chief Financial Officer | $ | 350,000 | $ | 435,969 | 24.56% | |||||

| President(1) | $ | 182,150 | $ | 250,000 | 37.25% | |||||

| Chief Operating Officer | $ | 446,516 | $ | 460,163 | 3.06% | |||||

| (1) | Mr. Griffith’s base salary was established by Mr. Dugan in the first quarter of 2018 and then increased in connection with his appointment to the role of President of the general partner in September 2018. |

2018 STIC

The STIC program is designed to deliver annual cash awards when the Company and its executives are successful in meeting or exceeding established performance targets and to pay less, or nothing at all, when the Company and/or its employees fall short of these targets. The STIC program provides incentive compensation (measured at target) that is comparable to compensation provided by companies with which the Company competes for executive talent. The description of the 2018 STIC program established by the Compensation Committee applied to all of the named executives for 2018, except that in the case of Mr. Griffith, his bonus opportunity performance, and aggregate payout were determined by Mr. Dugan in consultation with Mr. DeIuliis as to the aggregate payout amount.

For the 2018 STIC applicable to the January 1, 2018 – December 31, 2018 performance period, the Compensation Committee significantly re-designed and simplified the program to achieve key goals in the Company’s first year as a standalone pure-play E&P company based on achievement of (i) Adjusted EBITDA per share and (ii) pre-established individual performance goals.

Part One: Adjusted EBITDA/Share Goal:

EBITDA per share was calculated as described in “Calculation of Non-GAAP Financial Measures” below and, for executives at the time, had a score ranging from 0 – 200% (in the case of Mr. Griffith, 0-150%), with a score of 100% (in the case of Mr. Griffith, 75%) indicating target performance and a higher score of up to a maximum of 200% (in the case of Mr. Griffith, up to a maximum of 150%) indicating above-target performance as follows:

| Adjusted EBITDA/Share | Performance Level | EBITDA Score(1) |

| $4.00/share (based on $895M Adjusted EBITDA) |

Maximum | 200% |

| $3.828/share (based on $857M Adjusted EBITDA) |

Target | 100% |

| $3.777/share (based on $845M Adjusted EBITDA) |

Threshold | 70% |

| (1) | In the case of Mr. Griffith, the EBITDA Scores were 150% (maximum), 75% (target), and 52.5% (threshold). |

If the threshold, or minimum, score had not been achieved, a score of zero would have been assigned, with no payout. Upon achievement of the threshold, target, or maximum score, the EBITDA performance factor was determined based on such score, with total payout potentially modified by the individual performance factor described below. The target Adjusted EBITDA per share performance factor was derived from the annual Board of Directors-approved profit objective (“PO”) for the Company for 2018.

The “EBITDA Score” was then applied to the following formula:

The Adjusted EBITDA per share was achieved at $4.46/share (Adjusted EBITDA of $940M) resulting in the achievement of the goal at maximum for all of the named executives. The Compensation Committee determined that performance at maximum would have been achieved even without the Company’s stock repurchases in 2018.

| 11 |

Part Two: Individual Performance Goals:

In January 2018, the Compensation Committee approved individual strategic performance goals for the named executives (except for Mr. Griffith, whose goals were determined by Mr. Dugan). The goals (both quantitative and qualitative) were not assigned specific weighted percentages and the Compensation Committee (and Mr. Dugan, in the case of Mr. Griffith) determined achievement after considering performance as to the goals on a holistic basis. Performance relative to the goals was capped at 20% percent of the total STIC payout. The ultimate payouts for Messrs. DeIuliis, Rush and Dugan were a function of the degree to which job responsibilities were aligned with the established goals. The individual strategic performance goals (and related performance results) were as follows for Messrs. DeIuliis, Rush and Dugan:

| Quantitative(1) | Achieved? | Performance Results | |

| Achieve Adjusted EBITDA in excess of $857M ($3.828/share). | YES | $947M(2) ($4.46/share) | |

| Achieve a leverage ratio of 2.5 or less by year-end. | YES | 2.28 (E&P standalone basis) and 2.33 (consolidated basis) | |

| Stock buyback activity. | YES | 25.9M shares for $383M ($14.80/share) | |

| Increase net asset value (NAV)(2) per share by 10% by year-end 2018 (without regard to changes in commodity pricing), as determined using consistent NAV per share methodology. | YES | NAV per share increased by 40% in 2018. | |

| Qualitative | Achieved? | Performance Results | |

| Continue the delineation of the dry Utica in Southwestern Pennsylvania (SWPA), Central Pennsylvania (CPA) and Northern West Virginia (Northern WV). | YES | The Company continued to successfully delineate its Utica assets as follows: | |

| • | With respect to SWPA, the Company successfully completed and turned online the RHL11E Utica well and began to test the blend strategy. | ||

| • | The SWPA blend strategy was refined and at year-end, with the first SWPA pad was drilling ahead of schedule. | ||

| • | In CPA, the development strategy, including the data acquisition plan, acreage acquisition plan and a midstream buildout, were approved by management and included in the two-year plan. | ||

| • | In Northern WV, the delineation plan was approved by management and the WDTN 5 pad was under construction. | ||

| • | Participation via non-op working interest in the SWN Funka well (SWPA) and XTO HCPP well (CPA) also helped to further delineate the blend strategy and eastern extent of the Utica play burnout line respectively in 2017–2018. | ||

| • | The Bell Point 6 well in CPA was successfully completed and turned online in 2018 and represents a successful test of six inch production casing. | ||

| Hold an analyst day for the Company and Partnership. | YES | On March 13, 2018, management held an analyst and investor meeting for the Company and Partnership. The meeting was attended in person by 46 analysts and investors (with approximately 425 listeners on the webcast). | |

| Develop a process to methodically assess M&A opportunities and evaluate at least one strategic acquisition in the Appalachian Basin. | YES | The Company developed an M&A Matrix utilizing the SixSigma Pugh Scoring System to screen potential M&A candidates and prioritize resources. Using the Matrix, the Company can evaluate M&A opportunities with a weighted average scoring system that measures opportunities against a pre-established set of criteria and prioritizes them based on the asset’s (i) strategic fit, (ii) value creation potential and (iii) risk. If the screening evaluation exceeds a baseline score, then the asset will be evaluated further with an in-depth pro-forma analysis. | |

| At least 25% of all new hires will be diverse (that is, women and minorities) and at least 15% of all candidates interviewed will be in a minority group. | YES | 28.8% of all new hires were diverse and 15.3% of all candidates interviewed were from minority groups. | |

| (1) | In the case of Mr. Griffith, his goals were keeping premium transfer capacity high, recovering amounts from third parties related to excess pipeline capacity, and pricing and managing gas sale deals to attain a favorable pricing spread. After the end of the performance period, Mr. Dugan, in consultation with Mr. DeIuliis, considered his performance against these goals and determined that they were achieved. |

| (2) | See “Calculation of Non-GAAP Financial Measures” below. |

| 12 |

Based on the results of the 2018 STIC as shown above, the ultimate payouts to our named executives for 2018 performance were as follows:

| Named Executive | Target Opportunity Percentages (% of Base Salary)(1) |

Target Payout Opportunity |

EBITDA

Payout |

Payout |

Total Payout(2) | ||||||

| Chief Executive Officer | 120 | % | $ | 960,000 | $1,920,000 | $456,000 | $ | 2,376,000 | |||

| Chief Financial Officer | 70 | % | $ | 305,178 | $610,357 | $122,071 | $ | 733,000 | |||

| President | 40 | % | $ | 100,000 | $150,000 | $70,000 | $ | 220,000 | |||

| Chief Operating Officer | 65 | % | $ | 299,106 | $598,212 | $89,732 | $ | 688,000 | |||

| (1) | The Compensation Committee determined the 2018 target opportunity percentages for Messrs. DeIuliis, Rush and Dugan based on a review of competitive data and performance. The Compensation Committee approved the target opportunity percentages and payouts for Messrs. DeIuliis, Rush and Dugan. As described above, Mr. Dugan determined Mr. Griffith’s 2018 target bonus percentage consistent with Company-wide merit guidelines and determined the payout of Mr. Griffith’s award in consultation with Mr. DeIuliis. |

| (2) | Rounded up to the nearest thousand. |

LTIC

The Company’s LTIC program is designed to create a strong incentive for the named executives to achieve the longer-term performance objectives in the Company’s strategic plan and to align management’s interests with those of the Company’s shareholders. The Compensation Committee determined that Messrs. DeIuliis, Rush and Dugan would receive their entire 2018 long-term incentive opportunity in the form of PSUs and RSUs, with 55% of their respective target long-term incentive opportunity in the form of PSUs, and 45% in the form of time-based RSUs. In the case of Mr. Griffith, his 2018 long-term incentive opportunity and awards of PSUs and RSUs were recommended by Mr. Dugan and approved by Mr. DeIuliis consistent with the Compensation Committee’s philosophy described above as to the mix of such awards. The Compensation Committee believes that PSU awards align the interests of employees with those of the Company’s shareholders because the vesting of such awards is tied to the achievement of pre-approved, long-term performance goals related to the Company’s stock price.

A. 2018 PSU Grants and 2018 Tranche Metrics and Performance

In January 2016, 2017 and 2018, PSUs were granted that vest, if earned, ratably over a five-year period. The performance periods for the 2016 PSU Program, 2017 PSU Program and 2018 PSU Program (collectively, the “Programs”) are January 1, 2016 through December 31, 2020, January 1, 2017 through December 31, 2021 and January 1, 2018 through December 31, 2022, respectively. This five-year vesting period encourages retention among our executives.

| 13 |

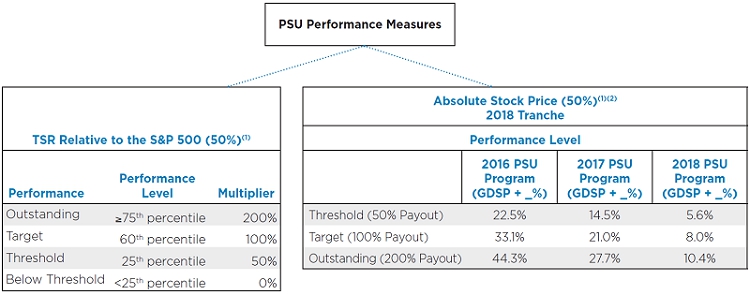

The vesting of the PSU awards is calculated annually based on the following pre-established, equally-weighted goals, with the aggregate payout capped at 200% of target:

| (i) | TSR relative to the S&P 500 (measured by comparing the Company’s 10-day average closing stock price ending December 31, 2018 and the companies in the S&P 500 as of that same date against their 10-day average close stock price ending on December 31st of the year prior to the grant date; dividends are included on a cash basis); |

| (ii) | Absolute stock price appreciation (comparing the Company’s 10-day average closing stock price ending on December 31 of each year during the five-year performance period against the 10-day average closing stock price ending on January 29, 2016 for the 2016 PSU Program ($5.26), January 31, 2017 for the 2017 PSU Program ($16.11) and January 30, 2018 for the 2018 PSU Program ($14.43) (collectively, the grant date stock prices or the “GDSPs”)). |

PSU Performance Measures TSR Relative to the S&P 500 (50%)(1) Performance Performance Level Multiplier Outstanding..75th percentile 200% Target 60th percentile 100 % Threshold 25th percentile 50% Below Threshold<25th percentile 0% Absolute Stock Price (50%)(1)(2) 2018 Tranche Performance Level 2016 PSU Program (GDSP + _%) 2017 PSU Program (GDSP + _%) 2018 PSU Program (GDSP + _%) Threshold (50% Payout) 22.5% 14.5% 5.6% Target (100% Payout) 33.1% 21.0% 8.0% Outstanding (200% Payout) 44.3% 27.7% 10.4%

| (1) | Straight line interpolation between performance levels. |

| (2) | After reviewing the Company’s prior stock price performance and consideration of the Company’s business plan, the Compensation Committee considered the stock price goals applicable to the remaining tranches of the PSU awards as confidential and challenging, but attainable. |

In the event that a tranche fails to pay out at the end of any annual tranche period with respect to the absolute stock price measure (a “Missed Year”), the unvested PSUs attributable to the Missed Year may still become fully vested, capped at the target level, if the Company achieves target performance (or greater) as determined after the end of a future tranche. The opportunity to recoup any missed payouts can occur for any prior tranche, but only up to target performance for that prior period. This is, in fact, a long-term feature of the program that continues to incentivize employees to take actions that result in stock price appreciation in future years and not disincentivize participants in the event one component is not achieved in one year.

Additionally, if the closing market price per share of the Company’s common stock equals or exceeds 200% for one or more future years, all unvested PSUs associated with those specific years will pay out at 200% immediately (“Special Vesting”). The Compensation Committee believes that this Special Vesting feature for the 2017 and 2018 PSU Programs (not included in the 2016 PSU Program) will help to enhance the retention of the executives. This furthers the Company’s Board of Directors’ objective of aligning shareholder and management interests to increase the stock price as soon as possible. If the Company achieves its goals for its shareholders sooner than expected, then management is appropriately compensated. This award term was not included in the CEO’s 2019 PSU award.

| 14 |

The Missed Year and Special Vesting provisions described above only apply to 50% of the 2017 and 2018 PSU awards (i.e., only the absolute stock price goal). In total, the Company’s Board of Directors believes that these features help the PSU program achieve an overall balanced approach by continuing to incentivize employees to operate the Company in a manner that will achieve long-term stock price appreciation in alignment with shareholders’ interests.

In January 2018, the Compensation Committee approved target awards for the 2018 PSU Program (as shown below).

| Named Executive | Aggregate

Dollar Value of 2018 PSU Awards |

|||

| Chief Executive Officer | $ | 3,300,000 | ||

| Chief Financial Officer | $ | 584,650 | ||

| President | $ | 40,040 | (1) | |

| Chief Operating Officer | $ | 1,045,000 | ||

| (1) | Mr. Griffith was appointed as an executive officer of the Partnership in September 2018 and as an executive officer of the Company in February 2019 (in each case, after the PSU awards were granted to the named executives at the beginning of fiscal 2018). The aggregate dollar value for Mr. Griffith shown above relates to his 2018 PSU award recommended by Mr. Dugan and approved by Mr. DeIuliis prior to his appointment. |

In January 2019, the Compensation Committee determined the payouts for each of the PSU Programs based on the Company’s relative TSR and absolute stock price performance during 2018. This determination was based on strict adherence to the formula described above.

2018 Tranche Performance of PSU Awards

The performance results for 2018 are shown in

the below chart.

| PSU Program | Performance Metric | Results | Units Earned | Weighting | Total

Units Earned (2018 Tranche Only) |

|||

| 2016 PSU Program | Relative TSR | 88th percentile | 200 | % | 50 | % | 200 | % |

| Absolute Stock Price | $11.69 (compared to maximum performance of $7.59) |

200 | % | 50 | % | |||

2017 PSU Program |

Relative TSR | 14.7th percentile | 0 | % | 50 | % | 0 | % |

| Absolute Stock Price | $11.69 (compared to threshold performance of $18.45) |

0 | % | 50 | % | |||

| 2018 PSU Program | Relative TSR | 33rd percentile | 66 | % | 50 | % | 33 | % |

| Absolute Stock Price | $11.69 (compared to threshold performance of $15.24) |

0 | % | 50 | % |

| 15 |

As a result of the achievement of the above performance factors, the named executives earned the following payout amounts under the 2018 tranches of the PSU Programs:

| Named Executive | PSU Program | 2018 PSU Tranche (at target) | Target Payout (%) | Payout Amounts (# of shares) | ||||||||||

| Chief Executive Officer | 2016 Program | 96,010 | 200 | % | 192,020 | |||||||||

| 2017 Program | 45,000 | 0 | % | 0 | ||||||||||

| 2018 Program | 48,245 | 33 | % | 15,922 | ||||||||||

| Chief Financial Officer | 2016 Program | 1,198 | 200 | % | 2,396 | |||||||||

| 2017 Program | 748 | 0 | % | 0 | ||||||||||

| 2018 Program | 8,546 | 33 | % | 2,822 | ||||||||||

| President | 2016 Program | — | — | — | ||||||||||

| 2017 Program | — | — | — | |||||||||||

| 2018 Program | 584 | 33 | % | 194 | ||||||||||

| Chief Operating Officer | 2016 Program | 22,400 | 200 | % | 44,800 | |||||||||

| 2017 Program | 14,249 | 0 | % | 0 | ||||||||||

| 2018 Program | 15,277 | 33 | % | 5,042 | ||||||||||

B. 2018 RSU Grants

In order to provide competitive compensation, retain key executive talent, and align management’s interests with the shareholders, in January 2018, the Company granted time-based, three-year ratable vesting RSU awards to all of the named executives, which in the case of Messrs. DeIuliis, Rush and Dugan were approved by the Compensation Committee. Mr. Griffith also received an RSU award in January 2018, which was approved by Mr. DeIuliis. The aggregate dollar values of the 2018 RSUs granted to the named executives were as follows:

| Named Executive | Aggregate

Dollar Value of RSU Awards |

||||

| Chief Executive Officer | $ | 2,700,000 | |||

| Chief Financial Officer | $ | 478,350 | |||

| President | $ | 32,760 | (1) | ||

| Chief Operating Officer | $ | 855,000 | |||

| (1) | Mr. Griffith was appointed as an executive officer of the Partnership in September 2018 and as an executive officer of the Company in February 2019 (in each case, after the RSU awards were granted to the named executives at the beginning of fiscal 2018). The aggregate dollar value for Mr. Griffith shown above relates to his 2018 RSU award recommended by Mr. Dugan and approved by Mr. DeIuliis prior to his appointment. |

C. Separation-Related Recognition Awards (RSUs)

Following the Separation and in consideration of the year-long process to transform the Company into a standalone pure-play E&P company, Mr. DeIuliis recommended that the Company’s Board of Directors approve special recognition awards for certain non-employee directors, executive officers, and key employees of the Company. In December 2017, the Company’s Board of Directors approved the following RSU and cash bonus awards to Messrs. Rush, Griffith and Dugan:

| Named Executive | RSU Awards(1) | Cash Awards | |||||

| Chief Executive Officer | N/A | (2) | N/A | (2) | |||

| Chief Financial Officer | $ | 200,000 | $ | 200,000 | |||

| President(3) | $ | 50,000 | $ | 50,000 | |||

| Chief Operating Officer | $ | 150,000 | $ | 150,000 | |||

| (1) | The RSU awards were granted on January 30, 2018 and will vest ratably over a three-year period on each anniversary of the grant date. |

| (2) | Mr. DeIuliis declined any special recognition award in connection with his role in the Separation. |

| (3) | In the case of Mr. Griffith, his recognition award was determined and approved by Mr. DeIuliis. Mr. Griffith was appointed as an executive officer of the Partnership in September 2018 and as an executive officer of the Company in February 2019 (in each case, after the grants of these awards to the other named executives). |

| 16 |

Other Compensation Policies and Information

Retirement Benefit Plans

During 2018, the Company maintained retirement benefit plans, which were intended to attract and retain key talent. The Company continues to move toward a single qualified defined contribution plan to deliver retirement benefits to its employees, as in 2018 it froze a nonqualified supplemental defined contribution plan in which employees participated. This action left only one supplemental plan in place, which is the Supplemental Retirement Plan (the “SERP”), in which only two active employees participate.

Change in Control Agreements

The Company has change in control agreements with certain named executives (the “CIC Agreements”). The CIC Agreements provide for a “double trigger” requirement, in that each named executive (Messrs. DeIuliis, Rush and Dugan) will receive cash severance benefits only if such named executive’s employment is terminated or constructively terminated after, or in connection with, a change in control (as defined in the respective CIC Agreements) and such named executive enters into a general release of claims reasonably satisfactory to us. Under these circumstances, the applicable named executives would be entitled to receive a lump sum cash severance payment equal to a multiple of base pay, plus a multiple of incentive pay (as defined in each named executive’s respective CIC Agreement) as follows:

| Named Executive | Multiple

of Base Salary and Incentive Pay |

| Chief Executive Officer | 2.5 |

| Chief Financial Officer | 1.5 |

| Chief Operating Officer | 2.0 |

Additionally, benefits would be continued for 18 to 30 months (as set forth in the applicable CIC Agreement) and equity grants would accelerate and vest in connection with a change in control alone.

The Compensation Committee believes that providing change in control benefits in the CIC Agreements and equity award agreements will motivate executives to take actions in the event of a proposed change in control that are in the best interests of the Company and its shareholders, while reducing the distraction of the potential impact of such a transaction on the named executive personally. To protect the business interests of the Company, the CIC Agreements and equity award agreements also contain confidentiality obligations, a one-year non-competition covenant and a two-year non-solicitation covenant. Additional terms of these agreements are more fully described in “Understanding Our Change in Control and Employment Termination Tables and Information” on page 31.

In connection with the Compensation Committee’s objective to provide compensation opportunities that will attract and retain superior executive personnel who will make significant contributions to the Company, the CIC Agreements that were entered into prior to 2009 (including Mr. DeIuliis’ CIC Agreement) provide for tax gross-ups in the event of a change in control (the CIC Agreements of Messrs. Rush and Dugan, which were entered into more recently, do not contain change in control tax gross-ups). If it is determined that any payment or distribution to or for the disqualified person’s benefit would constitute an “excess parachute payment,” the Company and/or certain affiliates will pay to the disqualified person a gross-up payment, subject to certain limitations, such that the net amount retained by the disqualified person after deduction of any excise tax imposed under Section 4999, and any tax imposed upon the gross-up payment, will be equal to the excise tax on such payments or distributions. In connection with incorporating gross-up provisions in the CIC Agreements entered into prior to 2009, the Compensation Committee determined that such gross-up payments were consistent with general market practice at that time such that the executive would receive the intended level of severance benefits not reduced by the 20% excise tax. It is Company’s policy not to provide tax gross-ups in future CIC Agreements, as evidenced by the more recent agreements with Messrs. Rush and Dugan.

| 17 |

Clawback Policy

The Compensation Committee and the Company’s Board of Directors approved the adoption of an executive compensation clawback policy, which provides that the Compensation Committee may seek to recover performance-based cash and equity incentive compensation awarded in 2014 and thereafter that were paid to an executive officer in the three years prior to a restatement as a result of the Company’s material non-compliance with the financial reporting requirements of the securities laws if (i) such officer is responsible for such restatement and (ii) the amount paid to the officer would have been lower had it been calculated based on such restated financial statements.

Stock Ownership Guidelines for Executives

The stock ownership guidelines provide that all employees designated as officers for purposes of the policy should own shares of the Company’s stock, the value of which is a multiple of base salary. The guidelines provide each officer with a five-year period from their appointment as an officer to achieve the applicable ownership level. Shares issuable upon the exercise of stock options or settlement of PSUs held by an individual are not counted for purposes of determining whether an individual has satisfied the ownership guideline requirement, which is as follows for the named executives.

| Named Executive | Ownership Guideline (Multiple of Base Salary) |

Actual

Ownership (Multiple of Base Salary(1)) |

Percentage

Compliance with Ownership Guideline |

| Chief Executive Officer | 5.5 | 20.06 | 365% |

| Chief Financial Officer | 3.5 | 3.87 | 111% |

| President(2) | 1.0 | 0.58 | 58% |

| Chief Operating Officer | 3.5 | 7.80 | 223% |

| (1) | Based on the Company’s 200-day average rolling stock price per share ended December 31, 2018 of $15.246. |

| (2) | Mr. Griffith assumed the position of President in September 2018, and it is expected that he will be in compliance with the ownership guideline requirement within the prescribed five-year period. |

The Company’s stock ownership guidelines were implemented by the Compensation Committee to further align the executives’ interests with those of its shareholders and to comply with what the Company believes are best practices. The Company reviews executives’ compliance with the stock ownership guidelines annually.

No Hedging/Pledging Policy

The Company’s and the Partnership’s Insider Trading Policies prohibit directors, officers (including named executives) and employees of the Company from engaging in any of the following activities with respect to securities of the Company or the Partnership (except as otherwise may be approved in writing by the Company’s General Counsel): (i) purchases of Company common stock or Partnership common units on margin; (ii) short sales; (iii) buying or selling options (other than the grant and exercise of compensatory stock options by the Company or the Partnership to directors, officers and employees), including buying or selling puts or calls or other hedging transactions with Company or Partnership securities; or (iv) pledging Company stock or Partnership common units (provided, however, that brokerage account agreements may grant security interests in securities held at the broker to secure payment and performance obligations of the brokerage account holder in the ordinary course).

Stock Retention Requirements

The Compensation Committee has implemented stock retention requirements applicable to the named executives and certain other employees for regular annual cycle PSU and RSU awards in which 50% of vested shares (after tax) must be held until the earlier of: (i) 10 years from the grant date or (ii) the participant reaching age 62.

| 18 |

Perquisites

The Company provides the named executives and other senior officers with perquisites that it believes are reasonable, competitive and consistent with the Company’s compensation program. The Company’s principal perquisite programs currently include club memberships, de minimis personal usage of Company-purchased event tickets, and a vehicle allowance. These programs are more fully described in the footnotes to the Summary Compensation Table. The Company does not provide tax gross-ups on Company-provided perquisite programs for the named executives.

Tax, Accounting, and Regulatory Considerations

While the Compensation Committee considers tax deductibility as one factor in determining executive compensation, the Compensation Committee also looks at other factors in making its decisions and retains the flexibility to award compensation that it determines to be consistent with the goals of the Company’s executive compensation program even if the awards are not deductible by it for tax purposes.

Section 162(m) of the Code generally places a $1 million limit on the amount of compensation a company can deduct in any one year for certain executive officers (and, beginning in 2018, certain former executive officers). Historically, the $1 million deduction limit generally has not applied to compensation that satisfies Section 162(m)’s requirements for qualified performance-based compensation. However, effective for taxable years beginning after December 31, 2017, the exemption for qualified performance-based compensation from the deduction limitation of Section 162(m) has been repealed, such that compensation paid to the Company’s executives in excess of $1 million will not be deductible unless it qualifies for the limited transition relief applicable to certain compensation arrangements in place as of November 2, 2017.

Although the Compensation Committee structured certain performance-based awards in a manner intended to be exempt from Section 162(m), and therefore not subject to its deduction limits, because of ambiguities and uncertainties as to the application and interpretation of the scope of the transition relief under the legislation repealing the performance-based compensation exemption from the Section 162(m) deduction limit, no assurance can be given that compensation intended to satisfy the requirements for exemption from Section 162(m), in fact, will. The Compensation Committee believes that the Company’s shareholder interests are best served if its discretion and flexibility in awarding compensation is not restricted, even though some compensation awards may result in non-deductible compensation expenses.

Calculation of Non-GAAP Financial Measures

Net Asset Value

Net Asset Value, or NAV, is a non-GAAP measure calculated as the present value of the Company’s future cash flows less the value of net debt as of a specific date. There is no comparable GAAP measure provided in the Company’s or the Partnership’s financial statements and, thus, no applicable reconciliation.

Adjusted EBITDA and EBITDA Per Share

The Company defines EBITDA as earnings before deducting net interest expense (interest expense less interest income), income taxes, and depreciation, depletion, and amortization.

Calculations for the 2018 Performance Period of the STIC

Adjusted EBITDA

EBITDA is defined as earnings before deducting net interest expense (interest expense less interest income), income taxes and depreciation, depletion and amortization. EBITDA and Adjusted EBITDA are not measures of performance calculated in accordance with GAAP, but instead are performance measures calculated consistent with the definition set forth in the Company’s quarterly and year-end earnings releases as furnished with the Company’s filings on Form 8-K. Items that the Company excludes from EBITDA to calculate Adjusted EBITDA may include the following:

| 19 |

| • | the effect of changes in accounting principles; |

| • | expenses associated with reorganizations and/or restructurings programs, including, but not limited to, reductions in force (pursuant to ASC 420) and early retirement incentives; |

| • | the impairment of tangible or intangible assets (pursuant to ASC 360); |

| • | gains or losses on the sale of assets, that are unusual in nature or infrequent in occurrence; |

| • | divestitures of EBITDA generating assets/businesses; |

| • | the unrealized portion of the gain or loss on derivative instruments; |

| • | non-cash portion of stock-based compensation; |

| • | financing and debt extinguishment fees; and |

| • | any other item that is unusual in nature or infrequent in occurrence and that will be reported in the Company’s earnings release. |

Adjusted EBITDA per Share

Equals Adjusted EBITDA divided by the basic shares of the Company’s common stock outstanding at the end of the one-year performance period, December 31, 2018. The basic shares of common stock outstanding will be consistent with the shares used in the Company’s year-end earnings release as filed on Form 8-K to calculate basic EPS from Continuing Operations.

| Calculation for the 2018 Performance

Period of STIC ($ in Thousands) |

December 31, 2018 | |||

| Net Income | $ | 883,111 | ||

| Add: Interest Expense | 145,934 | |||

| Less: Interest Income | (117) | |||

| Add: Income Taxes | 215,557 | |||

| Earnings Before Interest & Taxes (EBIT) from Continuing Operations | $ | 1,244,485 | ||

| Add: Depreciation, Depletion & Amortization | 493,423 | |||